Business

Ryan Bushell Names Top Canadian Dividend Stocks for August 2025

On August 15, 2025, Ryan Bushell, President and Portfolio Manager at Newhaven Asset Management, unveiled his top picks in the Canadian dividend stock market. His selections include Northland Power, Bell Canada Enterprises Inc., and Canadian Natural Resources Ltd. These choices reflect Bushell’s outlook on the current market conditions, which have shown resilience despite global trade barriers and economic uncertainties.

Market Performance and Outlook

Despite facing challenges such as geopolitical tensions and sluggish economic data, the markets have demonstrated unexpected strength. Historically, investors tend to react negatively to uncertainty, yet Bushell notes that markets can sometimes defy consensus expectations. The upcoming months could pose challenges for equity markets, particularly as new economic data becomes available and the potential impacts of tariffs are assessed.

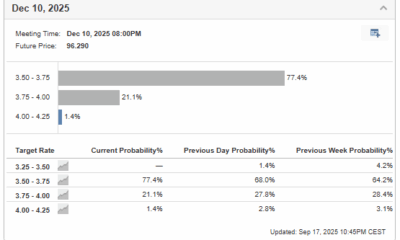

A key factor influencing the markets is the anticipated interest rate cut from the Federal Reserve, scheduled for September. While current Consumer Price Index (CPI) data does not preclude a rate cut, it does not strongly advocate for one either. With this backdrop, Bushell emphasizes a cautious approach for his clients, opting for a mix of infrastructure companies, reliable dividend stocks, and cash reserves to capitalize on potential opportunities.

Top Stock Selections

Bushell’s top pick, Northland Power (NPI TSX), has made significant strides in the renewable energy sector. The company has successfully completed the Oneida battery storage project ahead of schedule and under budget. Additionally, operations have commenced at the Hai Long project in Taiwan, and turbine installations are progressing at Baltic Power offshore Poland. With a capable management team and ongoing project execution, Northland is well-positioned for future growth.

Bell Canada Enterprises Inc. (BCE TSX) is another compelling choice, particularly following recent analyst upgrades. The company has been clarifying its strategy regarding the Ziply acquisition, which had initially raised concerns among investors. Bushell took advantage of lower stock prices to accumulate shares, confident in the long-term value of Bell’s asset portfolio. The recent turnaround in similar large-cap stocks, such as Manulife and TD, further reinforces his belief in BCE’s potential.

Lastly, Canadian Natural Resources Ltd. (CNQ TSX) remains an attractive investment despite current oil price challenges. The company’s recent agreement to supply feed gas for a Gulf Coast LNG project highlights its robust natural gas portfolio, which is often overlooked. With a nearly 6% dividend yield and the likelihood of further buybacks and dividend increases, CNQ presents a solid opportunity for investors.

Looking back at his past stock picks, Bushell noted the performance of several companies. For instance, Pembina Pipeline (PPL TSX) saw a return of -4%, while Arc Resources (ARX TSX) yielded a 16% return. Overall, the average total return across his selections was approximately 10%.

As markets evolve, Bushell’s insights provide valuable guidance for investors navigating the complexities of the Canadian economy. His strategic focus on dividend-paying stocks rooted in solid fundamentals offers a pathway for potential growth amidst uncertainty.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics1 week ago

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns