World

Powell Faces Pressure as Fed Considers Interest Rate Cuts

Federal Reserve Chair Jerome Powell is navigating a complex landscape as he signals the possibility of cutting the central bank’s key interest rate. This potential move, anticipated to be discussed in the September 2023 meeting, brings with it a challenge: maintaining the Fed’s independence amid pressures from the White House.

For months, Powell has resisted calls from President Donald Trump, who has been vocal about lowering borrowing costs. In a speech delivered at an economic symposium in Grand Teton National Park, Wyoming, Powell indicated a rate cut could be on the horizon, a statement that could be interpreted as aligning with Trump’s demands. Yet, Powell’s justification for a potential cut diverges significantly from the President’s perspective.

The Federal Reserve’s current short-term interest rate stands at 4.3%, a figure Trump has urged to be reduced to as low as 1%. This drastic reduction is not supported by Fed officials, who view such a move as inappropriate given the persistent inflation rates and economic conditions. Powell expressed concerns that while economic growth has slowed to an annual rate of 1.2%—down from 2.5% the previous year—there are still inflationary pressures that require careful consideration.

In his remarks, Powell highlighted the “marked slowing” in job demand, which poses a risk of rising unemployment. He noted that tariffs have contributed to increasing prices, complicating the Fed’s decision-making process regarding rate cuts. The central bank must strike a balance between stimulating the economy and controlling inflation, a task that becomes more intricate with political pressures from the administration.

The Federal Reserve’s commitment to its independence is considered vital for maintaining economic stability, as it allows for decision-making free from political influence. Beth Hammack, president of the Federal Reserve’s Cleveland branch, reaffirmed this commitment, stating, “I’m laser focused… on ensuring that I can deliver good outcomes for the public, and I try to tune out all the other noise.” Her sentiments reflect a broader concern among Fed officials regarding inflation, which Hammack described as “too high” and trending in the wrong direction.

While Powell did not explicitly address the issue of independence during his speech, analysts interpret this as a strategic choice to emphasize the Fed’s ongoing commitment to its mandate. Adam Posen, president of the Peterson Institute for International Economics, commented on this approach, suggesting that not addressing independence could signal a continued focus on responsible policymaking, even in the face of political pressures.

The situation is further complicated by Trump’s recent threats against Lisa Cook, a Federal Reserve governor. Trump suggested he would fire Cook if she did not resign, following allegations of mortgage fraud related to property purchases in 2021. Although Cook has not been charged with any crime, she has expressed her determination not to be intimidated into leaving her position. If she were removed, it would allow Trump to appoint a new member to the Fed’s governing board, potentially influencing future rate decisions.

Powell’s tenure as chair, which began in late 2017, is also under scrutiny as his term approaches its end in approximately nine months. Despite previous tensions, such as Trump’s criticism of Powell’s rate increases in 2018, Powell has maintained a stance of resisting external pressures. Economic policy experts like Michael Strain of the American Enterprise Institute note that while Trump has a history of pressuring Powell, it would be surprising if Powell were to relent on this matter before his term concludes.

As the Federal Reserve prepares for its upcoming meeting, the intersection of economic indicators and political influence will be critical. The balance between fostering growth and controlling inflation remains a delicate task for Powell and his colleagues as they navigate these turbulent waters. The decisions made in the coming weeks could have significant implications for both the economy and the Fed’s credibility as an independent institution.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics1 week ago

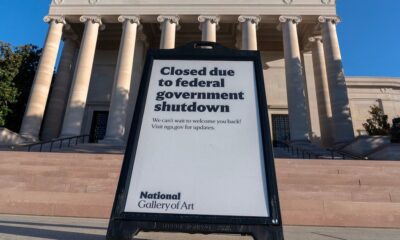

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns