Top Stories

Canadians Pour C$124 Billion into US Stocks Amid Trade Tensions

UPDATE: Canadian investors are defying trade tensions and tariffs imposed by US President Donald Trump, pouring a staggering C$124 billion (approximately $89.7 billion) into US stocks in 2025. This surge in investment comes despite ongoing conflicts and economic boycotts between the neighboring countries, indicating a strong attraction to the US market.

Latest data compiled by Warren Lovely at the National Bank of Canada reveals that this trend is on track to be the largest yearly inflow since at least the 1990s. Investors are seemingly ignoring calls to reduce US holdings, with many opting for the lucrative opportunities presented by US technology stocks, especially amid an artificial intelligence boom.

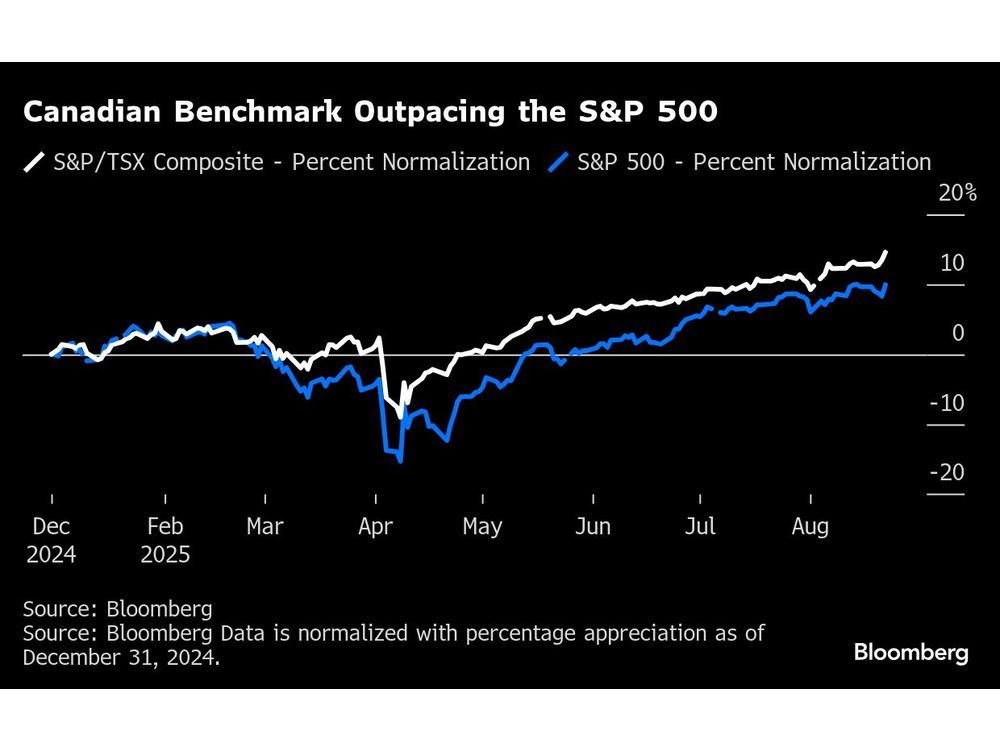

Greg Taylor, chief investment officer at PenderFund Capital Management Ltd., notes that Canadian investors are engaging in “performance chasing.” This year, while Canada’s benchmark index, the S&P/TSX Composite Index, has climbed nearly 15%, significantly outperforming the S&P 500 Index’s 10% gain, the allure of US equities remains irresistible.

Despite the growing tension between the two countries, which has led to Canadians boycotting US products and selling off American real estate, the influx of capital into US stocks continues unabated. This behavior contradicts a recent poll indicating that Canadians want pension fund managers to decrease US asset holdings.

The situation has been further complicated by Mark Carney, Canada’s Prime Minister, who announced on Friday that the country would remove retaliatory tariffs on the US, signaling a potential thaw in relations. Analysts are watching closely, as these developments could influence investor sentiment and market dynamics.

The buying spree is especially notable given that US liquor products have been pulled from Canadian store shelves and cross-border tourism has plummeted. According to Lovely, the current investment figures are “rather stunning” and highlight a disconnect between public sentiment and actual investment behavior.

Taylor suggests that while US stocks have been a strong performer in recent years, Canadian and European equities are starting to look more appealing. He warns that the US market appears “crowded and stretched,” advising cautious optimism as investors position themselves for future opportunities.

As July 2025 unfolds, all eyes will be on how these market dynamics evolve and whether Canadian investors will continue to favor US stocks despite the ongoing trade war. The implications for both economies are significant, and market participants should stay alert for any shifts that may arise in the coming weeks.

For now, the message is clear: Canadians are betting big on US stocks, even as tensions rise. This developing story is sure to have lasting impacts on investment strategies and economic relations between the two nations.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025