Top Stories

US Renewable Investments Plunge 36% Amid Trump Policies

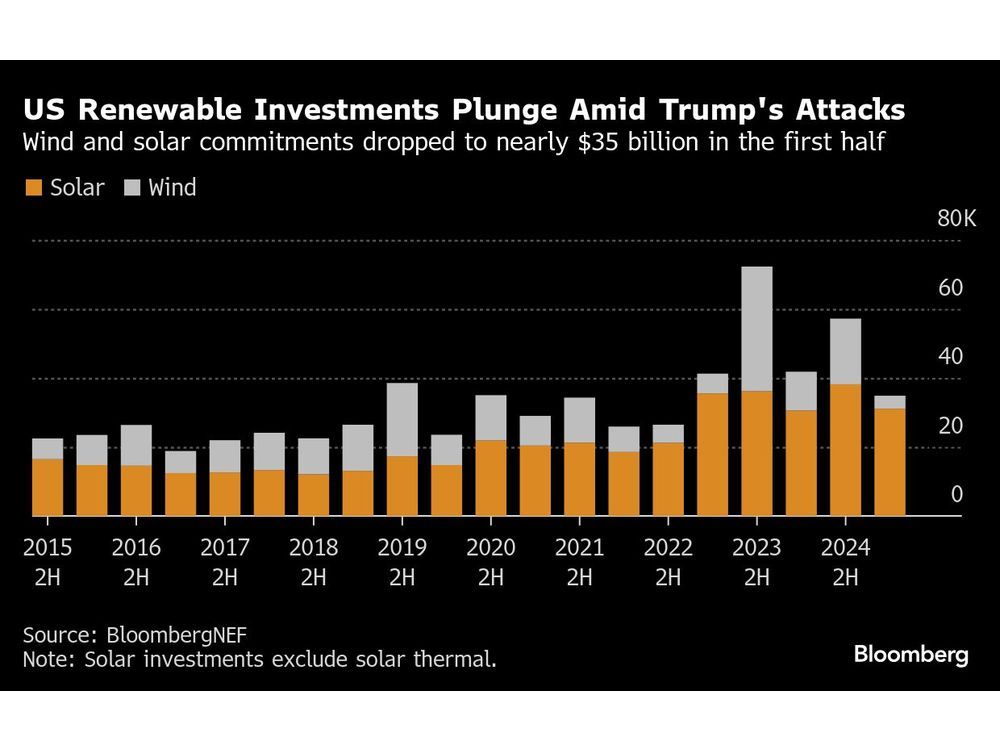

URGENT UPDATE: US investments in renewable energy projects have sharply declined by 36% in just the first half of 2024, according to a new report from BloombergNEF. Investments dropped by a staggering $20.5 billion as developers reacted to major policy shifts from the White House, significantly impacting investor confidence.

The report, released on Tuesday, highlights a troubling trend: commitments to both wind and solar energy have decreased by 18% compared to the previous six months. This decline comes amidst ongoing uncertainty, particularly regarding Donald Trump’s tariffs on renewable energy materials, which are further complicating the landscape for developers.

Meredith Annex, Head of Clean Power at BloombergNEF, stated,

“We’re really now seeing the impacts of what the new reality in the US has meant for investor confidence.”

The mood has shifted dramatically as Trump’s administration has shown a consistent bias against wind energy, which has contributed to a staggering 67% drop in investments for wind projects during the first half of this year compared to the same period in 2024.

In a concerning twist, spending on onshore wind installations has plummeted by 80% in the first half of this year when measured against the second half of 2024. While renewable energy sources like wind and solar have become the largest contributors to new power generation in the US, this growth has heavily depended on government subsidies, which have faced significant rollbacks due to the recent tax and spending bill enacted in July.

As electricity demand surges—driven by factors such as the increasing reliance on data centers and industrial electrification—this investment slowdown could have far-reaching implications. Investors are now eyeing more favorable markets, with the European Union witnessing a remarkable surge in renewable investments, totaling nearly $30 billion in the same period.

The urgency of this situation cannot be overstated. The decline in US renewable investments not only threatens the country’s energy transition but also raises alarms about the potential for a long-term shift in capital allocation towards international markets. As the US grapples with these policy changes, the ripple effects on job creation, technological innovation, and environmental sustainability are becoming increasingly evident.

Looking ahead, the focus will be on how the renewable energy sector adapts to these new conditions and whether any policy reversals could restore investor confidence. For now, the industry faces a daunting challenge as it navigates a landscape marked by uncertainty and shifting priorities.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics1 week ago

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns