Science

U.S. Military Technology Market Set to Surpass USD 10.4 Billion by 2032

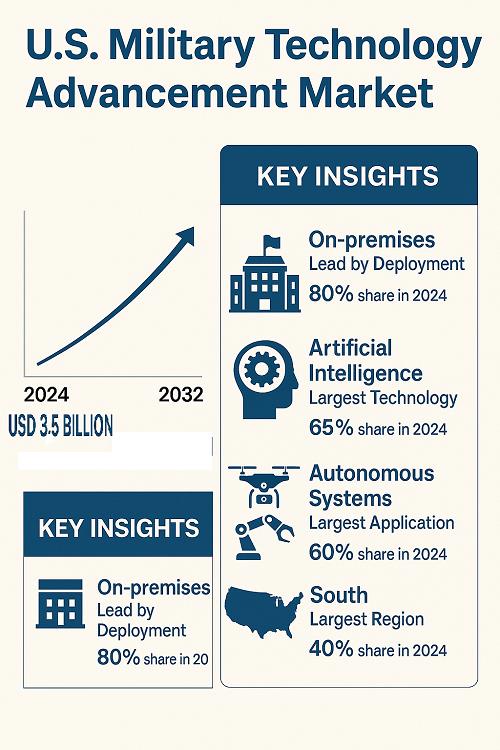

The U.S. military technology market is projected to reach a significant value of USD 10.4 billion by 2032, growing from USD 3.5 billion in 2024. According to a recent study by P&S Intelligence, this remarkable growth is expected to occur at a compound annual growth rate (CAGR) of 14.8% from 2025 to 2032. Key factors driving this expansion include increased defense budgets, the adoption of advanced technologies, and heightened geopolitical tensions that necessitate superior military capabilities.

Investments by the U.S. Department of Defense (DoD) are central to this growth. The DoD is focusing on next-generation defense assets such as hypersonic weapons, quantum communications, and robotic combat systems. Additionally, the government emphasizes public-private partnerships, which are vital for fostering innovation within military infrastructure. Enhancements in supply chain resilience and battlefield readiness are also major focus areas, promoting the development of advanced solutions that support joint mission success.

Market Dynamics and Trends

The market is characterized by several key trends. The on-premises deployment category represented 80% of the market share in 2024, attributed to the reliability of localized IT infrastructure in command centers and field operations. These systems maintain operational continuity even in areas with limited connectivity, making them vital for high-security, real-time military operations.

Conversely, cloud-based deployment is anticipated to experience the fastest growth through 2032. Partnerships between the DoD and leading cloud service providers such as AWS, Microsoft Azure, and Google Cloud facilitate seamless data sharing and real-time intelligence processing, enhancing decision-making across military branches.

In terms of technology, artificial intelligence (AI) dominated the market in 2024, holding a 65% share. This growth is primarily due to AI’s integration into autonomous systems, predictive analytics, and battlefield intelligence, which enhance real-time threat detection and support strategic decision-making while minimizing human risk.

Emerging Opportunities and Key Players

The sector of cyber warfare is expected to grow at the highest CAGR, driven by increasing threats from state-sponsored cyberattacks and digital espionage. Consequently, there is a growing demand for secure communications and AI-driven cyber defense mechanisms.

Within the application areas, autonomous systems accounted for the largest share at 60% in 2024, showcasing rapid growth. Their deployment in unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and robotic systems significantly enhances battlefield efficiency while reducing human risk. Initiatives like Project Maven by the DoD are significant contributors to this trend.

Geographically, the South of the U.S. dominated the market with a 40% share in 2024, owing to a high concentration of military bases, defense contractors, and government research centers situated in states like Virginia, Texas, and Florida. Companies such as Lockheed Martin and Northrop Grumman are pivotal players in this market.

The West region is expected to witness the most rapid growth, fueled by innovation in space-based defense and cybersecurity. Companies like SpaceX, Blue Origin, and Raytheon Technologies, primarily based in California and Colorado, are at the forefront of military technology modernization.

The market remains consolidated, with dominant firms such as Lockheed Martin, Northrop Grumman, Boeing, and RTX securing multi-billion-dollar defense contracts. These organizations maintain strategic collaborations with the DoD, ensuring they remain central to innovations in U.S. military capabilities.

In recent developments, the launch of military satellites in August 2024 aims to enhance communication in the Arctic. Additionally, Blue Origin secured a five-year Federal Aviation Administration (FAA) license in December 2024 to conduct orbital launches from Cape Canaveral, further underscoring the dynamic nature of the military technology landscape.

With these advancements, the U.S. military technology market is poised to not only grow significantly but also to evolve in ways that enhance national security and operational effectiveness.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025