Top Stories

US Companies Eye Pakistan’s Oil Reserves After Trump’s Claim

UPDATE: Just announced: US companies are expressing a strong interest in Pakistan’s oil and gas sector following a surprising claim from President Donald Trump about the country’s “massive” oil reserves. This developing situation has the potential to reshape energy investments in Pakistan.

In a meeting last week, Ali Pervaiz Malik, Pakistan’s Petroleum Minister, discussed enhanced energy cooperation with Natalie A. Baker, the US Charge d’Affaires in Islamabad. Malik revealed that talks are already underway with American firms regarding bids for exploration blocks, indicating a proactive approach to attracting foreign investment.

Baker emphasized the commitment of the US embassy to facilitate direct linkages between American and Pakistani companies, stating, “There is a strong and growing interest from US companies in Pakistan’s oil, gas, and minerals sector.” This comes as Trump’s social media post in July, which claimed Pakistan has approximately 9.1 billion barrels of recoverable shale oil, sparked intense interest in the nation’s energy capabilities.

However, this claim has raised eyebrows among industry veterans. Energy analyst Iqbal Jawaid estimates Pakistan’s actual reserves are closer to 238 million barrels, a modest figure compared to the oil giants like Saudi Arabia and Russia. The discrepancy underscores the challenges Pakistan faces in attracting foreign investments amid declining interest in its oil sector.

The US interest coincides with a tumultuous backdrop of trade tensions with India, where Trump criticized New Delhi for purchasing crude oil from Russia while suggesting that Pakistan could sell oil to India “some day.” This political backdrop adds layers of complexity to the burgeoning interest from US firms.

Historically, Pakistan’s oil sector has seen a decline in foreign investment, with major companies like Shell Plc exiting the market after decades of operation. The country is now looking to revitalize its energy landscape by announcing a bidding round for 40 offshore blocks, including in the Indus Basin. Bids are expected by the end of October 2023, creating an urgent opportunity for potential investors.

Despite the opportunities, experts warn of significant risks associated with exploring Pakistan’s reserves. Michael Kugelman, a senior analyst at the Asia Pacific Foundation of Canada, noted, “There would be significant risks for those looking to unearth Pakistani reserves, given shortages of technology and infrastructure and entrenched security challenges.”

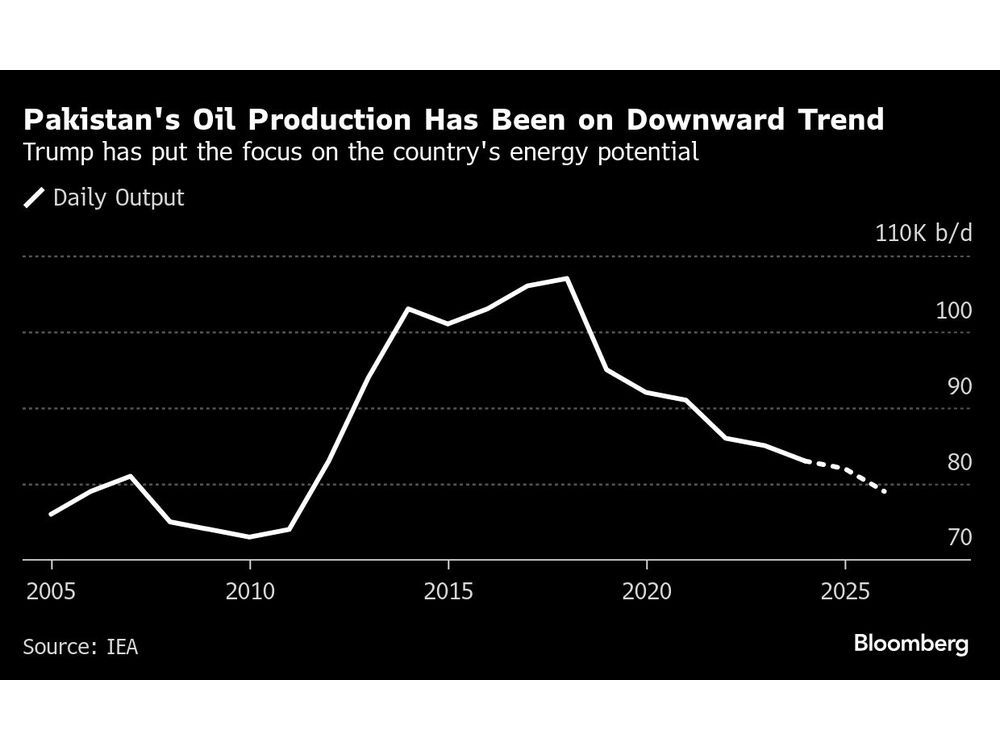

Any discoveries that enhance domestic oil production would serve as a boon for Pakistan, which currently spends approximately $11 billion annually on oil imports, accounting for nearly a fifth of the country’s total imports. The nation’s oil output has been declining since peaking in 2018, further emphasizing the need for revitalization in its energy sector.

As the situation develops, all eyes will be on the upcoming bidding round and how US companies respond to this emerging opportunity. The potential for collaboration between US and Pakistani firms could redefine the energy landscape in the region, making it a critical watchpoint for investors and policymakers alike.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025