Business

Yield Curve Shifts as Bond Market Reacts to Fed Pressures

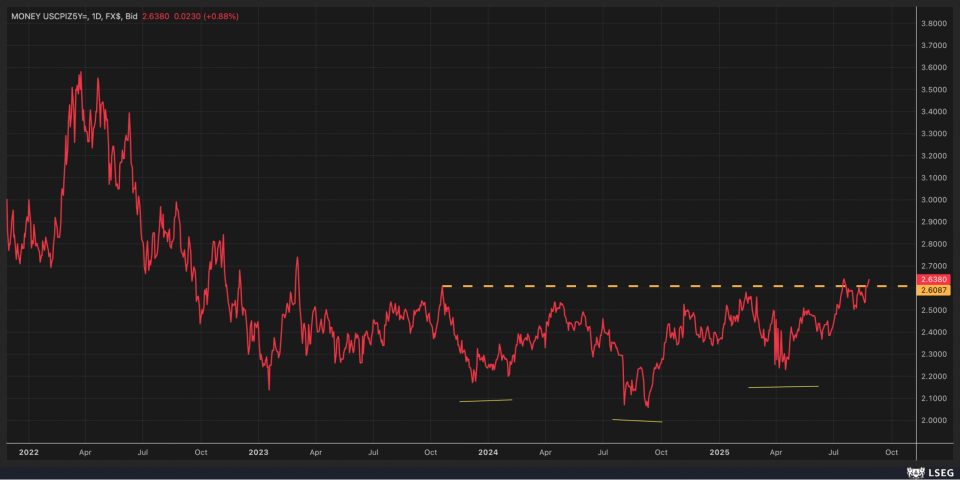

The bond market is experiencing notable shifts as the yield curve steepens, reflecting increasing pressures on the U.S. Federal Reserve. Recent data indicates a rise in five-year CPI inflation swaps to 2.64%, coinciding with heightened scrutiny of the Fed’s policy direction. President Donald Trump has publicly criticized Federal Reserve Governor Philip Cook, highlighting the political implications that may influence monetary policy decisions.

The current market dynamics have resulted in a steeper yield curve, characterized by a decline in short-term rates alongside a rise in long-term Treasury yields. Specifically, the yield on the 30-Year Treasury is hovering around 4.9%, suggesting a potential for significant movement in the near future. The widening spread between the 30-Year and the 10-Year Treasury has accelerated, now measuring 65 basis points, which underscores the growing divergence in investor expectations concerning future interest rates.

Historically, the gap between the 30-Year and the 10-Year Treasury has varied widely, reaching levels as high as 100 to 150 basis points. Additionally, the spread between the 30-Year and the 5-Year Treasury is also expanding, primarily influenced by a decline in the 5-Year Treasury rate.

Investors are closely monitoring the upcoming 5-Year Treasury auction scheduled for today, following a successful auction for the 2-Year Treasury yesterday, which contributed to lower yields in that segment of the market. The impact of 2-Year Treasury results is typically more closely tied to Fed policy, indicating that the forthcoming 5-Year and 7-Year auctions will provide clearer insights into market sentiment as they venture further from direct Fed influence.

Market participants are keenly aware that any significant shifts in the bond market could have profound implications for borrowing costs and overall economic activity. As the Federal Reserve navigates its path forward, the evolving yield curve serves as a critical indicator of investor confidence and expectations for inflation, growth, and monetary policy in the United States.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics1 week ago

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns