Top Stories

South Korea’s Inflation Drops to 1.7%, Easing Path for BOK Cuts

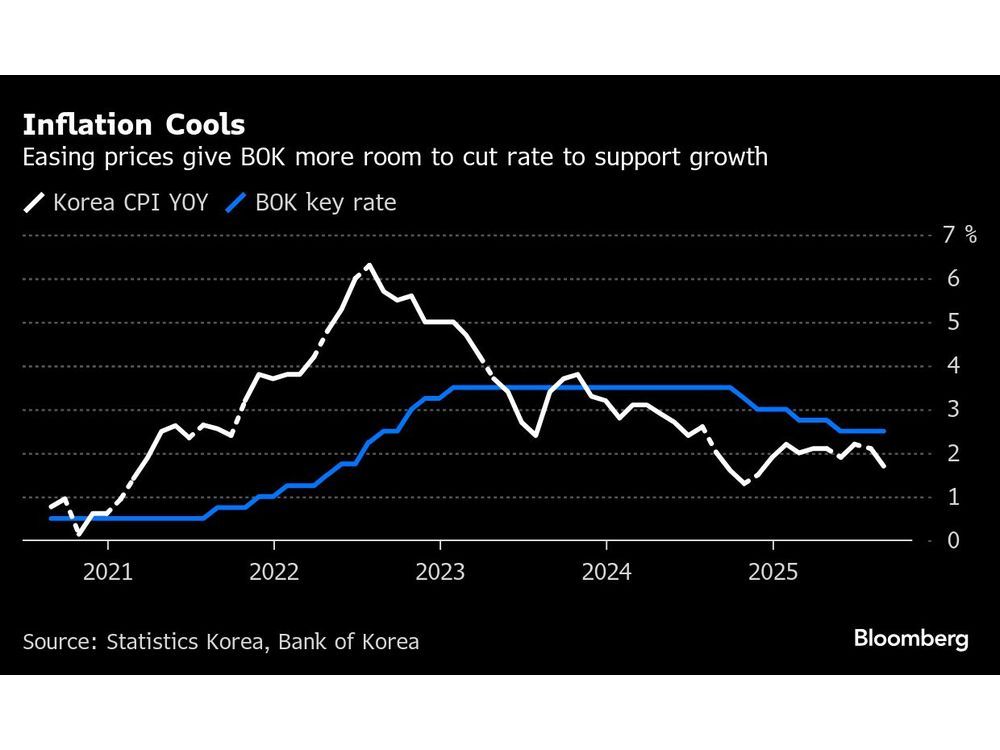

UPDATE: South Korea’s consumer inflation has just cooled to its lowest rate of the year, offering the Bank of Korea (BOK) more flexibility to resume interest rate cuts at its upcoming policy meeting on October 23, 2023. Consumer prices rose by only 1.7% year-on-year in August, a significant slowdown from the 2.1% increase recorded in July, according to data released by Statistics Korea.

This unexpected decline comes as a relief for policymakers, allowing them to consider further monetary easing amidst ongoing economic challenges. Economists had anticipated a slightly higher inflation rate of 1.9%, making the actual result a noteworthy surprise.

The slowdown in inflation is largely attributed to a temporary drop in communications costs. A significant price reduction—over 13%—followed SK Telecom’s decision to halve mobile bills for more than 20 million subscribers affected by a data breach. However, this dip is expected to reverse in September, potentially pushing inflation back up.

Alongside this, a core inflation gauge, which excludes food and energy prices, rose by just 1.3% in August, down from 2% in July. This marks the slowest growth rate in four years and falls below the expected 1.7% estimate.

As authorities evaluate the situation, the economic landscape appears resilient. Exports have surged for three consecutive months, retail sales have steadily increased for five years, and consumer confidence reached a seven-year high last month. However, the increased cost of living, particularly in essential areas like food and housing, continues to weigh heavily on households. Prices for food and non-alcoholic beverages climbed by 4.9% year-on-year, while housing-related costs rose by 1.3%.

The BOK’s Governor, Rhee Chang Yong, expressed caution regarding inflation forecasts, now set at 2% for this year and 1.9% for next. He emphasized that the bank considers not only consumer prices but also real estate trends when assessing price stability, given the impact of housing costs on overall inflation.

As the BOK prepares for its October meeting, the latest inflation figures may encourage a move to lower borrowing costs. Economists predict that the central bank could resume its easing cycle once concerns about the housing market subside.

Recent developments also highlight the backdrop of increasing pressures from global trade dynamics, particularly from President Donald Trump’s tariff initiatives, which have created additional burdens for South Korean businesses.

In summary, today’s inflation report signals a potential shift in monetary policy from the BOK, as they navigate the complexities of domestic economic pressures and international trade relations. The implications of these decisions will be closely monitored by market participants and everyday consumers alike.

Stay tuned for updates as we await the BOK’s next steps.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025