Top Stories

Urgent Update: ECB Set to Hold Rates Amid France’s Political Crisis

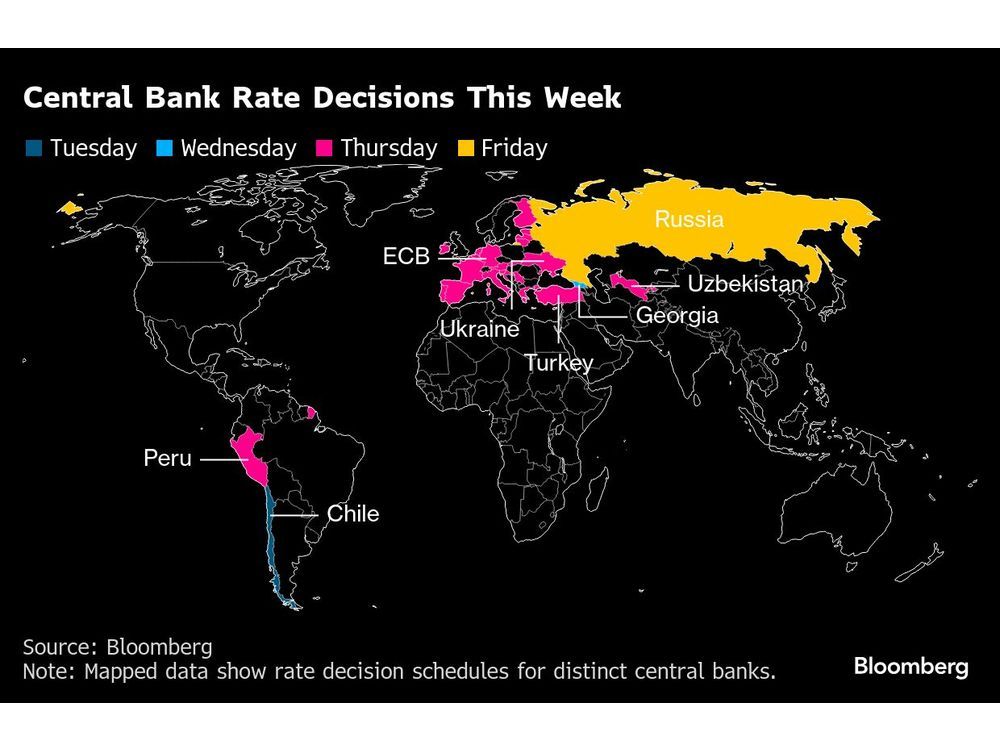

URGENT UPDATE: The European Central Bank (ECB) is expected to maintain current interest rates in a key meeting next week, even as a significant political crisis unfolds in France. Officials are set to gather in Frankfurt on September 16-17, 2023, amid rising tensions and uncertainty within the euro area.

As the ECB prepares to hold borrowing costs steady, the French government faces a potential collapse. Prime Minister François Bayrou is bracing for a confidence vote that he may lose, which could leave Emmanuel Macron scrambling to restore stability in the eurozone’s second-largest economy. This escalating situation is critical as it could directly impact fiscal policies in the region.

Investor anxiety has surged since Bayrou’s announcement, prompting scrutiny of France’s political stability and its implications for the broader European economy. Should Bayrou’s government fall, all eyes will shift to Macron for his response, exacerbating the challenges facing the ECB.

“The ECB is in no rush to lower rates again,” said David Powell, senior economist at Bloomberg Economics. “Policymakers are waiting for clearer signals on how the economy is responding to trade headwinds.”

President Christine Lagarde will be under intense scrutiny for any indications of the ECB’s willingness to mitigate turmoil from France. Her comments during the upcoming meeting will be pivotal for investors, particularly as the eurozone navigates potential economic fallout.

The ECB’s upcoming forecasts will also coincide with a key assessment from Fitch Ratings, which has a negative outlook for France. A potential downgrade could further complicate the ECB’s position as it addresses inflationary pressures and economic uncertainties.

The decision to hold rates steady comes as the ECB continues to monitor inflation trends, especially in light of the recent trade deal with the US that imposed tariffs on European goods. This decision reflects a cautious approach in a rapidly changing economic environment.

As the situation develops, analysts will be closely observing how the political drama in France influences the ECB’s policy decisions and the economic landscape of the eurozone. With global economic factors, including the upcoming US Federal Reserve meeting, adding further complexities, the stakes are high for European policymakers.

Stay tuned for more updates as this story unfolds, and watch for Lagarde’s key announcements that could shape the financial future of Europe.

-

World2 months ago

World2 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment2 months ago

Entertainment2 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle2 months ago

Lifestyle2 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science2 months ago

Science2 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology1 week ago

Technology1 week agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Sports2 months ago

Sports2 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Technology2 months ago

Technology2 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics1 month ago

Politics1 month agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics2 months ago

Politics2 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment2 months ago

Entertainment2 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Entertainment1 month ago

Entertainment1 month agoLeon Draisaitl Marries Celeste Desjardins in Lavish Ceremony

-

Entertainment2 months ago

Entertainment2 months agoBINI Secures Five Nominations at 2025 Jupiter Music Awards