Sports

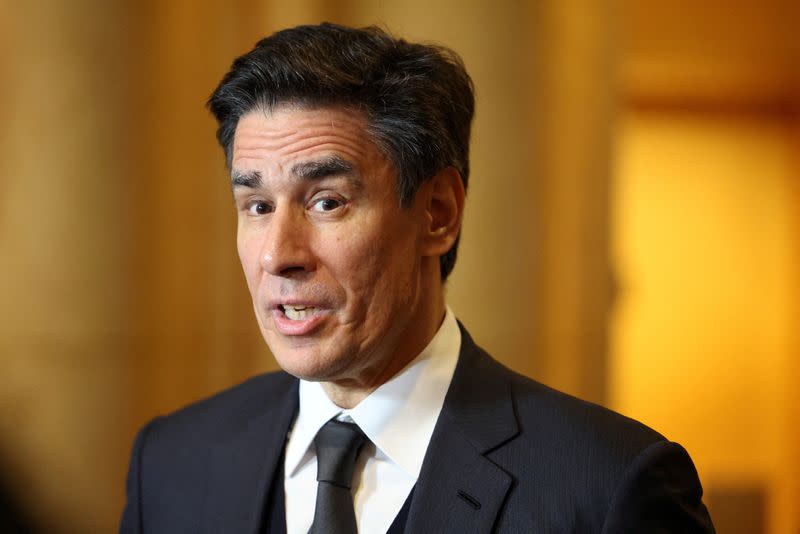

ANZ Bank’s New CEO Nuno Matos Implements Major Changes

ANZ Group is entering a transformative phase under the leadership of new CEO Nuno Matos, who has announced significant changes aimed at revitalizing the bank’s performance. Investors are prepared for some immediate challenges, including the likelihood of a dividend reduction. This shift comes as the bank grapples with a series of costly decisions to address operational inefficiencies and regulatory penalties.

In a recent announcement, ANZ revealed plans to reduce its workforce by 3,500 staff, which will incur a one-off cost of A$560 million (approximately $373.24 million). Additionally, the bank will pay A$240 million in penalties to the Australian Securities and Investments Commission (ASIC) due to systemic failures in its operations, including accusations of acting “unconscionably” in a government bond transaction.

Strategic Moves Under New Leadership

Since taking over from long-serving CEO Shayne Elliott in May 2023, Matos has set a clear agenda to streamline operations and enhance accountability within the organization. Fund managers view these actions as necessary steps to reset the bank’s trajectory. As Matos begins to implement his strategy, investors are bracing for potential short-term impacts but remain optimistic about the long-term outlook.

The decision to downsize the workforce aligns with Matos’ commitment to creating a more agile and efficient organization. By reducing staff, ANZ aims to cut costs and redirect resources toward areas that will drive growth in the future. This restructuring is seen as essential in a competitive banking landscape where operational efficiency is critical.

Implications for Investors and the Banking Sector

The anticipated dividend cut is a significant concern for shareholders who have relied on consistent payouts. While the exact timing and extent of this reduction remain unclear, analysts speculate that it could be a necessary compromise to support the bank’s recovery efforts. Investors understand that the short-term pain may lead to long-term gain if Matos’ strategy proves effective.

As ANZ navigates this challenging period, the impact of these changes will be closely monitored by both analysts and competitors in the banking sector. The success of Matos’ initiatives may not only reshape ANZ’s fortunes but also set a precedent for other financial institutions facing similar pressures.

In summary, Nuno Matos is positioning ANZ Group for a critical turnaround, implementing significant workforce reductions and addressing regulatory concerns. While investors prepare for near-term challenges, the overarching goal remains focused on restoring the bank’s competitive edge in the Australian banking market.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Top Stories2 weeks ago

Top Stories2 weeks agoFamily Remembers Beverley Rowbotham 25 Years After Murder

-

Top Stories5 days ago

Top Stories5 days agoBlake Snell’s Frustration Ignites Toronto Blue Jays Fan Fury