Business

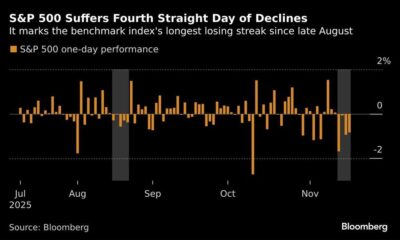

S&P 500 Hits 27th High in 2025 but Ends Week Lower at 0.3% Decline

The S&P 500 index reached its 27th new high of 2025 on September 25, peaking at a record level before experiencing a decline of 0.3% by the end of the week. Despite this weekly downturn, large-cap stocks outperformed their small-cap counterparts, highlighting a notable shift in investor sentiment.

Investors flocked to commodities, with gold and energy sectors standing out as the week’s strong performers. In contrast, blockchain assets such as Bitcoin and Ether faced significant setbacks, reflecting changing preferences in the market. The trend saw cyclical and value stocks outperform growth stocks, indicating a sector rotation as investors moved from riskier assets to more defensive plays.

Analysts suggest that while the ongoing bull market is impressive, a market correction before the year’s end could be beneficial. Many high-quality stocks are currently trading at elevated valuations, creating a scenario where a pullback may provide an opportunity for more sustainable growth.

The S&P 500’s journey to its latest high began on the morning of September 25, marking a significant milestone in a year characterized by robust performance. Although the index enjoyed two positive trading days, it was unable to fully recover from three down days, resulting in a net decline for the week.

Investors are closely watching the overall market dynamics, particularly the performance of tech giants NVIDIA (NVDA) and Alphabet Inc. (GOOGL), both of which play crucial roles in the market’s trajectory. As noted, the current market environment is one that requires careful navigation, especially as valuations continue to climb.

Amid the fluctuations, some experts argue that the shift towards defensive positions may signal caution among investors. This sentiment aligns with the broader market narrative that emphasizes the need for a balanced approach in portfolio management, especially in a time when many stocks are priced for perfection.

In summary, while the S&P 500 continues to set new highs, the recent decline underscores the volatility inherent in the market. With significant movements in commodity prices and blockchain assets, investors must remain vigilant as they strategize for the remainder of the year.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025