Top Stories

Europe Begins Winter with Gas Reserves Over 82% Full

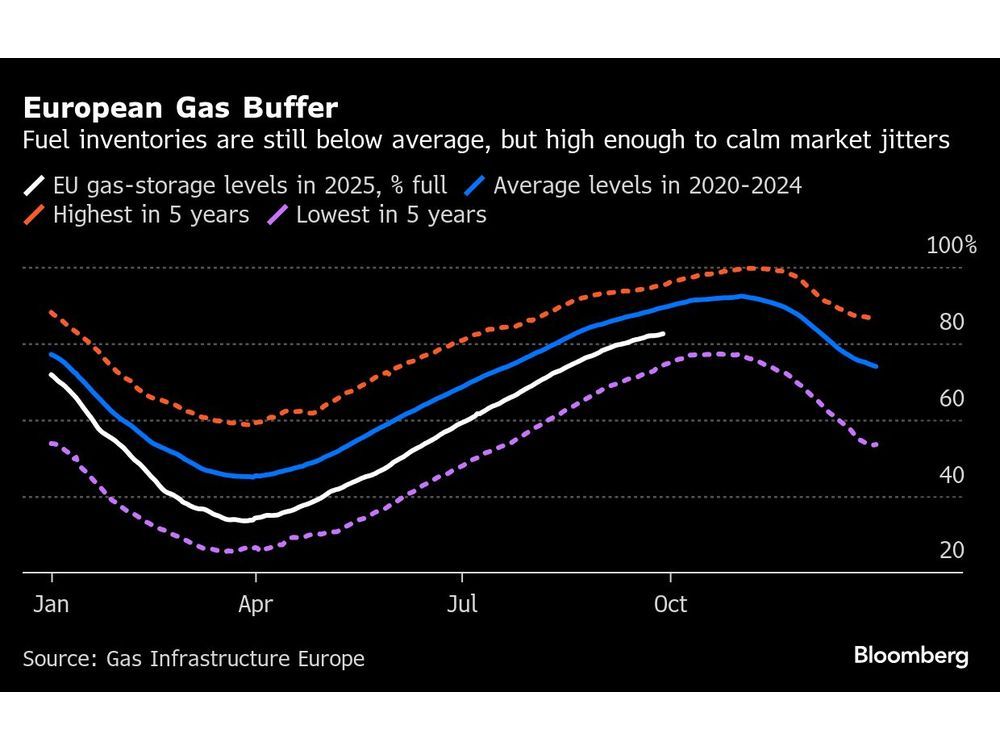

URGENT UPDATE: Europe is kicking off the heating season with gas storage levels exceeding 82%, providing a buffer against market volatility as the colder months approach. This surge in reserves comes as a relief after a turbulent start to 2025, but the true challenge lies ahead.

As of early October, storage facilities across the European Union are more than 82% full, thanks to an aggressive summer stockpiling campaign. Analysts are closely monitoring the situation, particularly as forecasts predict a colder October. “We are in a relatively good place,” stated Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management, emphasizing the uncertainty that a harsh winter could bring.

The implications of these stock levels are significant. Typically, Europe’s gas reserves cover about one-third of winter demand, and their current fullness is a critical indicator of the continent’s ability to navigate the lingering effects of the energy crisis triggered by Russia’s invasion of Ukraine. Although gas prices have receded from the crisis peaks of 2022, analysts warn that cold weather could once again strain supply chains.

Injections from April through September have been robust—about a third higher than the previous year, as reported by Gas Infrastructure Europe. This increase was bolstered by subdued demand from China and reduced consumption from European industries. However, recent weeks have seen a slowdown in refilling efforts, affected by maintenance work in Norway and Algeria and an early cold snap.

Looking ahead, stocks are projected to reach nearly 89% by the end of October. According to Tom Marzec-Manser, director for Europe gas and LNG at Wood Mackenzie, this would be “more than sufficient to support European winter-time supply.” Nevertheless, discrepancies exist within the bloc: while France has surpassed 90% storage capacity, Germany, the largest consumer, has only achieved 29% at its Rehden site, far from its 45% target.

The situation is equally precarious in the UK, which has the lowest storage capacity in Europe. The largest gas storage site there was not refilled this summer, increasing dependency on imports, especially liquefied natural gas (LNG).

As October progresses, the continent braces for a colder start, with wind levels expected to decrease. This shift could heighten the reliance on gas for power generation. A severe winter could significantly deplete reserves, with forecasts suggesting they could drop as low as 22%, compared to the five-year average of 45%.

With geopolitical tensions and potential new sanctions on Russian exports looming, traders remain on edge. “The looming LNG glut is poised to ease gas balances,” noted Sadnan Ali, an oil and gas analyst at HSBC Holdings Plc. However, he cautioned that “the balance would look tighter in the event of a colder than average winter.”

As Europe navigates this critical juncture, the coming months will be pivotal in determining whether the region can maintain stability in its energy markets. Stay tuned for ongoing updates as this situation develops.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025