Top Stories

Oil Prices Steady as OPEC+ Announces Supply Increase Today

URGENT UPDATE: Oil prices have steadied after a modest advance, following OPEC+’s recent decision to increase production quotas. As of today, Brent crude is trading above $65 a barrel, while West Texas Intermediate stands near $62.

In a critical move over the weekend, OPEC+ members, including Saudi Arabia, agreed on a supply increment of 137,000 barrels per day. This decision comes as traders are closely analyzing lower-than-expected prices from Saudi Arabia, which have surprised the market that anticipated an increase.

After experiencing back-to-back losses in August and September, concerns about an impending surplus have loomed large. OPEC+ has been gradually ramping up output to reclaim market share, despite a surge in production from rival drillers in the Americas. This development is vital as it could significantly affect oil market dynamics moving forward.

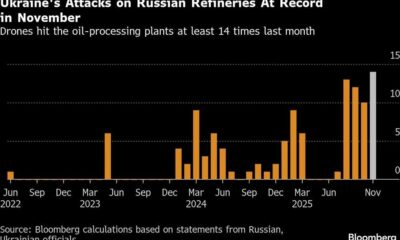

Moreover, traders are on high alert regarding recent Ukrainian attacks on Russian energy infrastructure, which could potentially disrupt supplies. The situation remains fluid as geopolitical tensions continue to impact the oil market.

The futures curve for Brent indicates softer market conditions, with the prompt spread—the difference between the two nearest contracts—narrowing to a 40-cent premium from nearly $1 at the end of last month. This shift suggests that the market is now pricing in looser near-term balances.

“Markets have been worried since OPEC+ started boosting production quotas in April 2025 that additional OPEC+ barrels would exacerbate oversupply conditions,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia.

Looking ahead, analysts predict that if global inventories continue to expand and diesel margins retreat, Brent prices could hold between $60 and $65 a barrel, indicating a potential decline in oil demand.

This ongoing situation highlights the intricate balance within the global oil market, where supply decisions are crucial for pricing and economic stability. As developments unfold, industry watchers will need to stay tuned for further updates. The immediate impact of these decisions will resonate with consumers and businesses alike, making it essential to monitor the effects on fuel prices and energy strategies globally.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025