Health

Comprehensive Financial Checklists Enhance Client Advisory Services

In an effort to improve the quality of financial advice, financial advisor Kevin Greenard has introduced a comprehensive checklist designed to ensure that all key documents are complete. This initiative, launched in January 2024, aims to enhance the advisory process for clients in the United Kingdom, Australia, and the United States.

Understanding a client’s financial standing is similar to a doctor reviewing a patient’s health history. Greenard emphasizes that having a detailed overview of clients’ financial backgrounds enables advisors to provide tailored and effective recommendations. The checklist focuses on critical documents, including tax returns, investment portfolios, and estate planning documents.

Enhancing Client Relationships through Structured Processes

Greenard’s approach stems from a recognition that many financial advisors often overlook essential paperwork during initial consultations. By implementing a structured checklist, advisors can better assess their clients’ needs and build stronger relationships. This method not only improves the completeness of client files but also increases overall trust between advisors and clients.

“Clients deserve the best possible advice, and that starts with knowing their financial history inside and out,” Greenard stated. He believes that thorough preparation leads to more insightful discussions and ultimately better financial outcomes for clients.

The checklist requires advisors to gather specific documentation, including:

– Last two years of tax returns

– Current investment account statements

– Insurance policies

– Retirement account details

– Estate planning documents

By standardizing this information gathering process, Greenard aims to minimize errors and omissions that could impact financial planning.

Impacts on Financial Advisory Standards

The introduction of this checklist aligns with broader trends in the financial advisory industry, where regulatory bodies are increasingly emphasizing the importance of comprehensive client assessments. Organizations such as the Financial Planning Association have advocated for enhanced standards in client documentation and advisor accountability.

As clients become more aware of their financial needs, they expect advisors to deliver personalized and informed guidance. Greenard’s initiative is a proactive step toward meeting these expectations. By ensuring completeness in documentation, advisors can more effectively address client concerns and aspirations.

In addition to improving client satisfaction, the checklist may also have implications for compliance and risk management within advisory practices. By maintaining thorough records, firms can better protect themselves from potential liabilities and ensure adherence to industry regulations.

The financial advisory landscape is evolving, and innovations like Greenard’s checklist are essential for staying relevant and competitive. As the industry faces increasing scrutiny and client demands, structured processes will likely play a pivotal role in shaping future advisory services.

Ultimately, the goal is to transform client interactions and enhance the quality of financial advice delivered, ensuring that all clients receive the comprehensive support they need to navigate their financial journeys successfully.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories7 days ago

Top Stories7 days agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

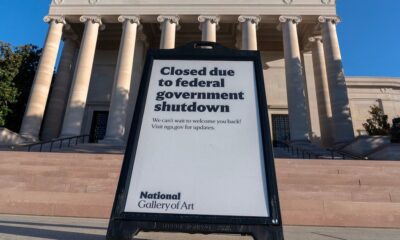

Politics1 week ago

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns