Top Stories

IMF Raises 2025 Growth Forecast Amid Looming U.S.-China Trade War

URGENT UPDATE: The International Monetary Fund (IMF) has just announced an increased global growth forecast for 2025, now predicting a rise to 3.2 percent, up from 3.0 percent in July. This adjustment comes despite escalating tensions surrounding a potential renewed trade war between the United States and China, which could severely impact economic output.

In its latest World Economic Outlook released earlier today, the IMF cited more favorable tariff conditions and improved financial circumstances. However, the looming threat from U.S. President Donald Trump, who has threatened 100% duties on Chinese goods in response to Beijing’s recent export controls, casts a shadow over this optimism. The situation remains volatile, as experts warn that such an escalation could significantly disrupt the global economy.

IMF chief economist Pierre-Olivier Gourinchas remarked, “Not as bad as we feared, but worse than necessary.” He emphasized the need for immediate action to avoid a downturn that could chill investment and spending. Authorities report that initial discussions are underway to mitigate the rising tensions between the U.S. and China.

Despite these risks, several factors have contributed to the IMF’s optimistic revision. Recent trade agreements have lessened the anticipated impact of Trump’s tariffs, while an agile private sector has managed to adapt swiftly by optimizing supply chains and increasing imports. Additionally, fiscal stimulus in Europe and China, alongside a surge in artificial intelligence investments, has bolstered growth.

The IMF’s projections for 2026 remain stable at 3.1 percent, indicating a cautious outlook. However, a potential trade war could lead to dire consequences. In a downside scenario where tariffs increase significantly, global growth could decline by as much as 1.2 percentage points in 2026, with further repercussions expected through 2028.

The outlook for the United States remains relatively strong, with growth projected at 2.0 percent for 2025, a slight upgrade from the previous forecast of 1.9 percent. Similarly, the Eurozone is expected to grow by 1.2 percent, with anticipated contributions from fiscal expansions in Germany and robust economic activity in Spain.

Meanwhile, Japan has seen its growth forecast rise to 1.1 percent for 2025, driven by increased export activity and domestic consumption. However, growth is expected to slow to 0.6 percent in 2026.

In Latin America and the Caribbean, growth is also expected to improve to 2.4 percent for 2025, primarily due to anticipated gains in Mexico, which has been upgraded to 1.0 percent growth. Meanwhile, China’s growth forecast remains unchanged at 4.8 percent for 2025, despite persistent challenges in its property sector.

The IMF has kept its global inflation forecast steady at 4.2 percent for 2025, though variations are noted between countries. Inflation expectations in the U.S. are rising as businesses begin to pass on tariff-related costs to consumers, while forecasts for some Asian nations have been adjusted downward.

As the IMF and World Bank prepare for their annual meetings this week, the global economic landscape appears increasingly uncertain. Stakeholders will be closely monitoring the developments in U.S.-China relations, as any escalation could reshape the current economic forecast dramatically.

Stay tuned for further updates as this story evolves.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics1 week ago

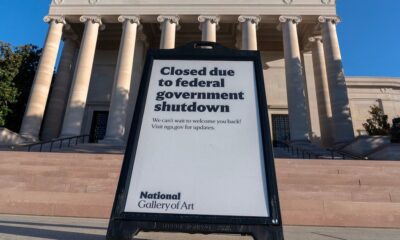

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns