Business

Trade Tensions Rise as U.S. Imposes New Tariffs on China

Trade tensions between the United States and China escalated significantly on October 10, 2023. U.S. President Donald Trump announced the imposition of additional tariffs on Chinese goods in response to China’s stringent controls over rare earth exports. This move marks a renewed phase in the ongoing trade conflict between the two largest economies in the world.

The latest tariffs come as part of the U.S. government’s strategy to assert its position in the global supply chain of critical materials. Rare earth elements, which are essential for various high-tech products, have become a focal point in these trade discussions. The Chinese government has implemented strict controls on the export of these materials, causing concern in U.S. industries that rely heavily on them.

In a statement, Trump emphasized that the tariffs would serve to protect American interests and promote domestic manufacturing. He argued that China’s export limitations on rare earths pose a direct threat to U.S. economic security. “We cannot allow our economy to be held hostage by foreign powers,” Trump stated during a press conference.

The ongoing trade dispute has significant implications for U.S.-listed Chinese companies. Analysts have begun to identify key stocks that could be impacted by the renewed tensions. Investment firms have ranked the top ten Chinese stocks listed in the U.S. based on their potential resilience amid these developments.

Impact on U.S.-Listed Chinese Stocks

The escalating tariffs could lead to increased volatility in the stock prices of Chinese firms operating on U.S. exchanges. Among the stocks highlighted by analysts are major players in technology and manufacturing sectors, which are likely to be affected by both tariffs and supply chain disruptions.

Companies like Alibaba Group, Baidu, and Tencent Holdings are under scrutiny as investors reassess their potential for growth in light of the new tariffs. These firms have built substantial operations in the U.S. and are pivotal in the global technology landscape.

Market analysts suggest that investors should be cautious but also vigilant regarding potential opportunities. As some stocks may fall due to immediate reactions to the tariffs, others might present a chance for strategic investment over the long term.

Future Outlook

Looking ahead, the outcome of this latest round of tariffs remains uncertain. Both the U.S. and Chinese governments have expressed a willingness to negotiate, but tensions have historically made discussions challenging. The international community is closely monitoring the situation, as it could have far-reaching implications for global trade.

The imposition of tariffs on Chinese goods not only impacts bilateral relations but also raises questions about the future of international trade norms. As countries grapple with the complexities of trade dependencies, the decisions made in the coming weeks will likely shape the economic landscape for years to come.

In summary, the renewed trade tensions between the U.S. and China highlight the fragility of global supply chains and the ongoing challenges faced by companies navigating these turbulent waters. As the situation unfolds, stakeholders across industries are urged to stay informed and adapt to the rapidly changing environment.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories7 days ago

Top Stories7 days agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics1 week ago

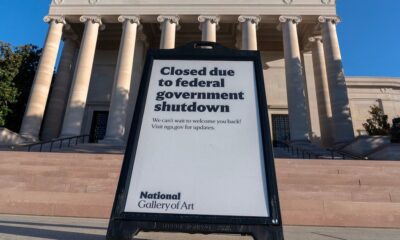

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns