NEW YORK – Investors Prepare for Uncertain Markets Following US Strikes on Iran

Markets are poised for a turbulent week as investors digest the ramifications of the United States’ recent military actions against Iran. Over the weekend, the U.S. launched strikes on three Iranian nuclear facilities, a move that could have significant implications for global financial markets.

Immediate Impact

President Donald Trump announced on Saturday evening that Iran’s nuclear enrichment facilities had been “obliterated” by U.S. strikes. The full extent of the damage remains under assessment, and the potential for an Iranian response has left investors wary. This uncertainty is likely to drive a shift away from riskier assets like stocks and cryptocurrencies, while oil prices are expected to rise due to concerns over potential disruptions to supply chains.

Key Details Emerge

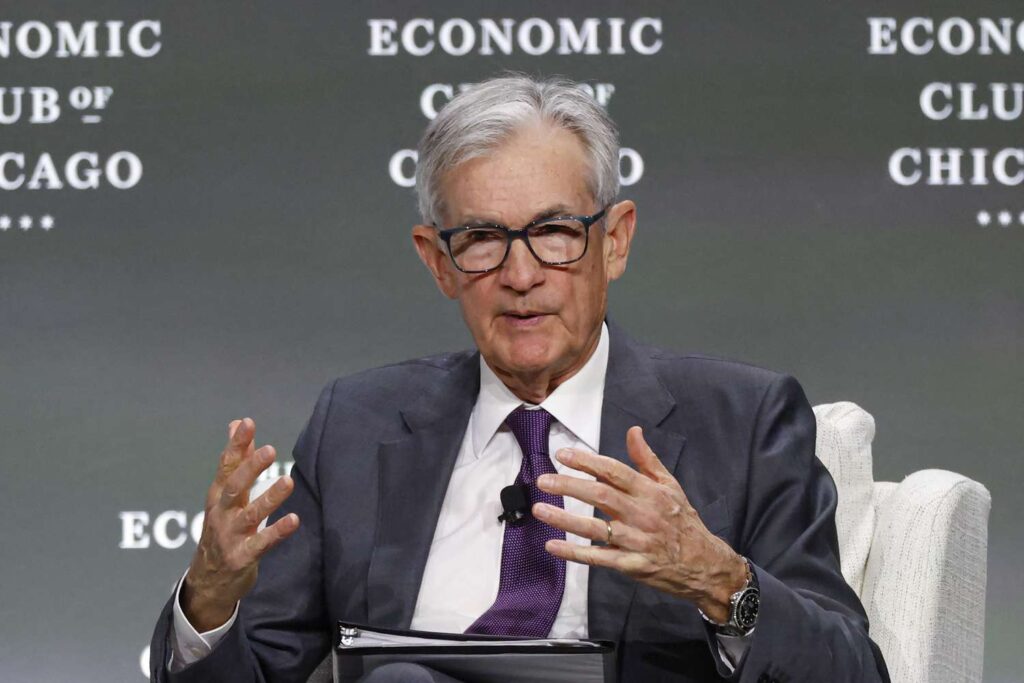

In addition to geopolitical tensions, financial markets will be closely watching Federal Reserve Chair Jerome Powell’s testimony to Congress this week. Powell is set to discuss the central bank’s economic outlook following their decision to maintain interest rates last week. The May Personal Consumption Expenditures (PCE) report, a key measure of inflation, will also be released, potentially influencing future monetary policy decisions.

Key Statistics: The PCE report is critical as it informs the Fed’s inflation target of 2%. April’s PCE was slightly above this target.

Industry Response

Corporate earnings reports will also be in focus this week, with Nike, FedEx, and Micron Technology among the major companies scheduled to announce their quarterly results. These reports will provide insights into how tariffs and global trade dynamics are impacting corporate performance.

Nike, FedEx, Micron Earnings in Focus

Nike, part of the Dow 30, will release its earnings on Thursday. The company previously warned that tariffs could affect its financial results. Meanwhile, FedEx’s earnings on Tuesday will offer a glimpse into the health of shipping volumes and, by extension, the global economy. Micron’s report follows its recent announcement of a $200 billion investment in U.S. semiconductor production.

By the Numbers: Nike, FedEx, and Micron represent key sectors—retail, logistics, and technology—that are closely watched by investors for broader economic signals.

What Comes Next

As the week progresses, investors will also monitor updates on existing home sales, consumer confidence, and GDP data. These economic indicators will provide further clarity on the health of the U.S. economy amid ongoing trade tensions and geopolitical uncertainties.

Powell Congressional Testimony Follows Rate Decision

Following last week’s Federal Reserve meeting, Jerome Powell’s testimony before Congress will be closely scrutinized. He will address the House Financial Services Committee on Tuesday and the Senate Banking Committee on Wednesday, with the potential for market-moving insights, especially given President Trump’s criticism of the Fed’s interest rate stance.

The PCE report, due on Friday, will be a critical data point for assessing inflation trends. Analysts expect it to offer clues on whether inflation is aligning with the Fed’s target, influencing future interest rate decisions.

Background Context

The U.S. strikes on Iran come amid heightened tensions over nuclear proliferation and regional stability. The timing is particularly significant as it coincides with crucial economic reports and corporate earnings that could further sway market sentiment.

Regional Implications

Oil markets are likely to be particularly sensitive to developments in the Middle East, with potential supply disruptions posing risks to global energy prices. The geopolitical landscape remains fluid, and any escalation in tensions could have far-reaching economic consequences.

Timeline of Events

- Monday, June 23: Existing home sales (May), Fed speakers, Key Earnings: FactSet, Commercial Metals Company, KB Home

- Tuesday, June 24: Consumer confidence (June), Powell testifies before House Financial Services Committee, Key Earnings: FedEx, Carnival, TD Synnex, AeroVironment

- Wednesday, June 25: New home sales (May), Powell testifies before Senate Banking Committee, Key Earnings: Micron, Paychex, General Mills, Jeffries

- Thursday, June 26: Pending home sales (May), Key Earnings: Nike, McCormick, Walgreens Boots Alliance, Acuity

- Friday, June 27: Personal Consumption Expenditures (May), Key Earnings: Apogee Enterprises

As the week unfolds, market participants will be keenly attuned to any developments that could impact financial markets, from geopolitical shifts to economic data releases. The stakes are high, and investors will need to navigate a complex landscape of risks and opportunities.