Business

German Firms Invest Billions in China Despite Economic Risks

Germany’s business sector is deepening its ties with China, with corporate investment in the country rising to €5.7 billion ($5.9 billion) for 2024, up by €1.3 billion ($1.5 billion) from the previous year. This trend highlights a significant commitment from major German exporters, despite growing concerns about the risks involved in relying on the world’s second-largest economy for future profits.

The increase in investment is confirmed by the Mercator Institute for China Studies, which notes that the automotive and chemical sectors are leading the charge. In particular, car manufacturers are pivotal, accounting for approximately two-thirds of German investments in China from 2020 to 2024. This includes substantial commitments from companies like BMW AG, Mercedes-Benz AG, and Volkswagen AG, which have established China as a critical market.

German officials are aware of the economic risks associated with this dependence but have not actively intervened to alter the course of foreign investments. Although discussions are taking place about the need to diversify, there is a reluctance to impose restrictions. One senior government official noted that such interventions do not align with Germany’s historical approach to foreign investment.

Investment Trends and Economic Implications

The automotive sector alone saw a 69% increase in investment to reach €4.2 billion in 2024. BMW is investing around €3.8 billion in a battery project in Shenyang, while Mercedes-Benz has shifted its annual strategy summit to Beijing to align closely with the Chinese market. Meanwhile, BASF, the chemical giant, has recently opened an €8.7 billion complex in China—the largest investment in its history—underscoring the importance of the Chinese market for its growth strategy.

Despite these substantial investments, discussions among business leaders and government officials reveal a lack of solutions to address the deeper issues at play. The question of who bears the cost of distancing from China remains largely unanswered. Executives express that they see little reason to change course unless there is government support or intervention.

The upcoming visit of Lars Klingbeil, Germany’s Vice Chancellor and Finance Minister, to Beijing signals a recognition of these concerns. Meanwhile, Chancellor Friedrich Merz has publicly warned companies about their exposure to China, emphasizing that the consequences of continued inaction could be severe. The more Germany entwines its economy with China, the greater the potential for Beijing to wield influence over Europe’s largest economy.

Shifting Perspectives on Investment

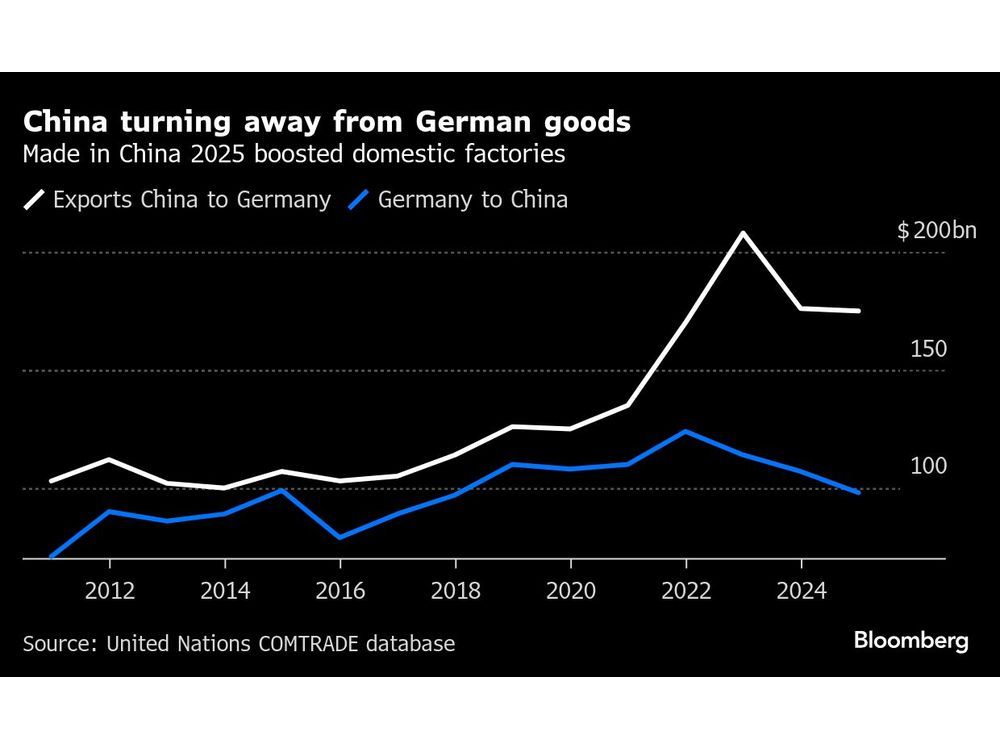

Some German firms are already reconsidering their reliance on China. For example, 4Jet, a smaller laser technology company, has sought to diversify its market presence by focusing on regions like India. CEO Jörg Jetter expressed concerns regarding China’s industrial policies, which favor domestic companies through significant subsidies. He stated, “I find politics astonishingly naive,” highlighting the need for a more strategic approach to international markets.

While larger firms continue to pour investments into China, smaller companies are wary of the risks associated with such dependence. The German Economic Institute has warned that the ongoing trend of shifting production to China may lead to a gradual erosion of Germany’s industrial base.

Business associations, such as the VDMA, have reported a decline in competitiveness among their members in relation to China, with fewer than half feeling optimistic about their prospects over the next five years. This situation has prompted calls for government intervention, as many companies feel the need for a supportive framework to navigate the changing landscape.

The German government has recognized the need for action. Since taking office, Chancellor Merz has initiated a national security council to address these concerns. The council aims to develop an action plan by the end of the year to diversify Germany’s raw material supply sources and enhance economic security.

Despite these efforts, Merz has made it clear that companies must take responsibility for their investments. “That’s your risk if things go wrong, please don’t come to us,” he stated, cautioning that Chinese authorities could quickly disrupt supply chains and access to the market.

As the global landscape shifts, German firms face a critical juncture. Balancing the pursuit of profits in China with the imperative to safeguard long-term economic stability will require careful consideration and strategic planning. The decisions made today will shape not only the future of these companies but also the broader economic landscape of Germany.

-

Politics1 week ago

Politics1 week agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Top Stories3 weeks ago

Top Stories3 weeks agoFamily Remembers Beverley Rowbotham 25 Years After Murder