Business

Asian Markets Set for Gains Despite Ongoing US Selloff

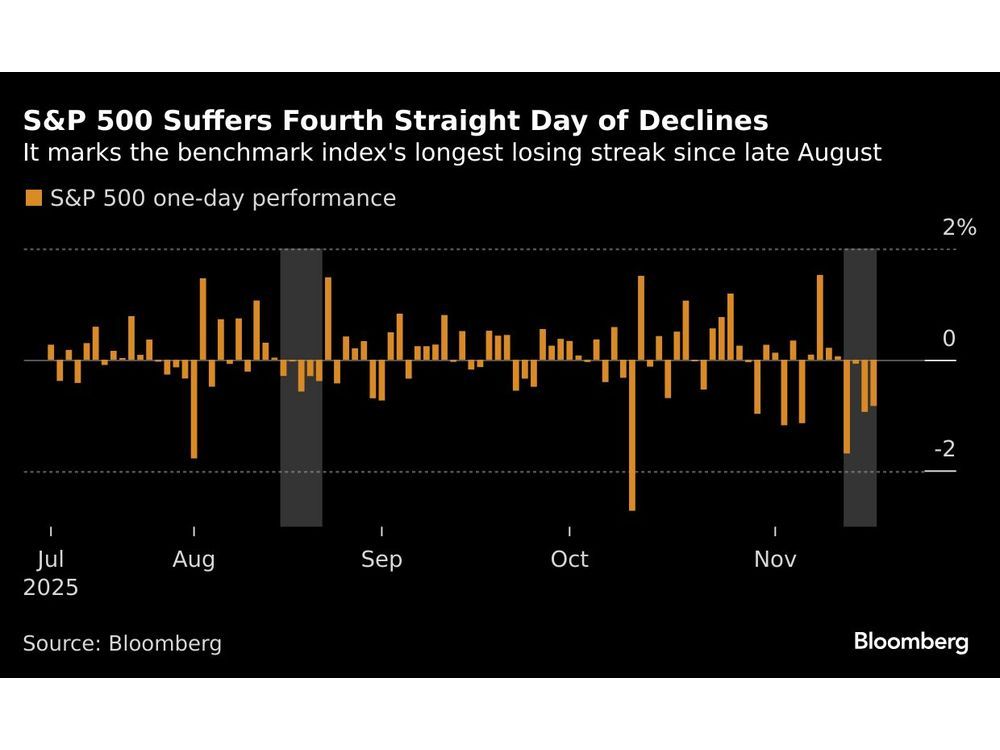

Asian stock markets are poised for a positive opening, despite a significant selloff on Wall Street where concerns over inflated valuations in the artificial intelligence (AI) sector continue to mount. Futures for equity indices indicate potential gains in Japan and Hong Kong, while Australia is expected to experience a slight decline. This follows a four-day losing streak for the S&P 500 index, marking its longest downturn since August.

The performance of major tech firms has been a focal point, particularly the “Magnificent Seven,” which saw a decline of 1.8%. Notably, shares of Nvidia Corp., a key player in the AI market, fell by 2.8% ahead of its anticipated earnings report set to be released after the market closes on Wednesday.

Investors remain wary as the AI sector grapples with the challenge of justifying substantial investments against revenue and profit generation. Both Microsoft Corp. and Nvidia are reportedly committing up to a combined $15 billion to Anthropic PBC, an AI developer closely associated with their rival, OpenAI. Sonu Varghese, a strategist at Carson Group, noted, “The question isn’t really whether we’re in a bubble. The real question is how long the current trend in AI spending will last and how bad the fallout will be when it ends.”

The S&P 500 has dropped more than 3% this month, positioning it for its worst November since 2008. This renewed volatility is evident in Wall Street’s “fear gauge,” the Cboe Volatility Index, which has surpassed 24, a level that often raises alarms among traders.

Concerns extend to the Federal Reserve’s monetary policy, particularly regarding potential interest rate cuts. Current market expectations reflect a less-than-50% probability of a rate reduction in December, as several policymakers have expressed caution against such moves due to inflation risks. Nevertheless, Fed Governor Christopher Waller reiterated his support for lowering rates.

In the bond market, Treasury yields are witnessing their first consecutive gains of the month, with the yield on 10-year Treasuries falling three basis points to 4.11%. This trend aligns with signs of weakening in the U.S. labor market. The Labor Department reported jobless claims totaling 232,000 for the week ending October 18, while ADP Research revealed an average loss of 2,500 jobs per week in the four weeks concluding November 1. The recent government shutdown has delayed the release of official employment data, leaving uncertainty in its wake.

James Demmert from Main Street Research noted that if Thursday’s jobs report reflects weaker-than-expected numbers, it could pave the way for the Fed to implement a rate cut, potentially sparking a year-end rally that could drive the S&P 500 to 7,100.

In a broader context, Nvidia has grown to surpass the combined size of the energy, materials, and real estate sectors. Ryan Grabinski of Strategas highlighted that Nvidia’s market weight even exceeds the industrials sector, indicating its significant influence on both U.S. and international markets. The upcoming earnings report from Nvidia could shift market sentiment back toward optimism, although expectations remain high.

As traders await Nvidia’s results, they will also focus on the delayed September U.S. jobs report, which is scheduled for release on Thursday. In commodities, oil prices have risen amid expectations of tighter sanctions on Russia, as articulated by the European Union’s top diplomat. Gold prices, in contrast, have shown volatility.

Overall, the Asian markets are watching closely as they prepare for the trading day, with significant implications for global financial stability stemming from the current trends in the U.S. market.

-

Politics2 weeks ago

Politics2 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Top Stories4 weeks ago

Top Stories4 weeks agoFamily Remembers Beverley Rowbotham 25 Years After Murder