Top Stories

Invesco Bets Big on UK Stocks Amid Market Uncertainty

URGENT UPDATE: Invesco is doubling down on UK stocks, despite a wave of caution among global fund managers. Ciaran Mallon, who oversees the £3.4 billion Invesco UK Equity High Income fund, expressed optimism about the market’s prospects, especially as investors brace for next week’s budget announcement from Chancellor of the Exchequer Rachel Reeves.

As concerns mount over the UK government’s financial strategies, fund managers have slashed their holdings of London stocks by the highest margin in over three years, according to a recent Bank of America Corp. survey. Despite this backdrop, Mallon asserts, “The UK stock market is full of wonderful businesses… so I’m very optimistic about the UK stock market right now.”

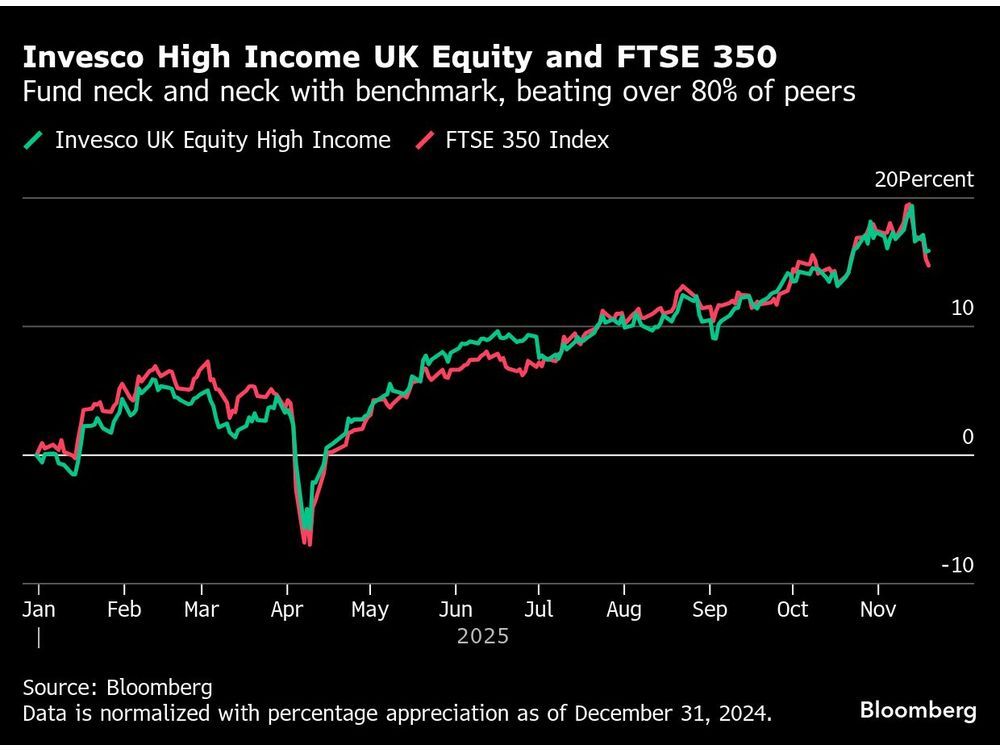

The Invesco fund is outperforming the market with a remarkable 16% return this year, outpacing the FTSE 350 and beating over 80% of its peers. The FTSE 350 is on track for its best performance since 2013, sparking renewed interest in UK equities.

Mallon highlights that UK stocks are trading at a near-record 35% discount compared to global peers, with a forward price-to-earnings ratio below 13. Strong household balance sheets, increasing savings, and rising wages contribute to his positive outlook.

“The government will likely seek to attract investors to the London stock market,” Mallon noted, reflecting a shift in sentiment observed from both local and international clients. Notably, over a fifth of the fund’s assets are allocated to UK financial stocks, primarily banks, which have surged 42% this year.

Mallon emphasized the fund’s long-standing confidence in UK banks, citing their strong management and robust earnings growth. Major holdings include Barclays Plc, which has seen a remarkable 50% increase this year, and Lloyds Banking Group Plc. “Their focus on shareholder returns aligns well with our fund’s objective,” he stated.

In addition to banking stocks, Invesco’s portfolio includes around 9% in energy shares, investing heavily in oil giants like Shell Plc, BP Plc, and TotalEnergies SE. Mallon praised the oil sector’s current capital discipline and strategic focus on shareholder value.

With a clear call on electrification trends, the fund also holds significant positions in companies like National Grid Plc, which has substantial operations in the US, and water utilities benefitting from anticipated investments in the UK’s infrastructure.

As the financial landscape remains volatile, investors will be closely watching the government’s budget announcement next week for clues on future economic direction. Invesco’s bold stance amidst uncertainty signals a potential turning point for UK equities, making this a critical moment for market watchers and investors alike.

Stay tuned for further updates as the situation develops.

-

Politics2 weeks ago

Politics2 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Lifestyle2 months ago

Lifestyle2 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations