Business

Lee County Board Approves 2025 Property Tax Levy and Budget

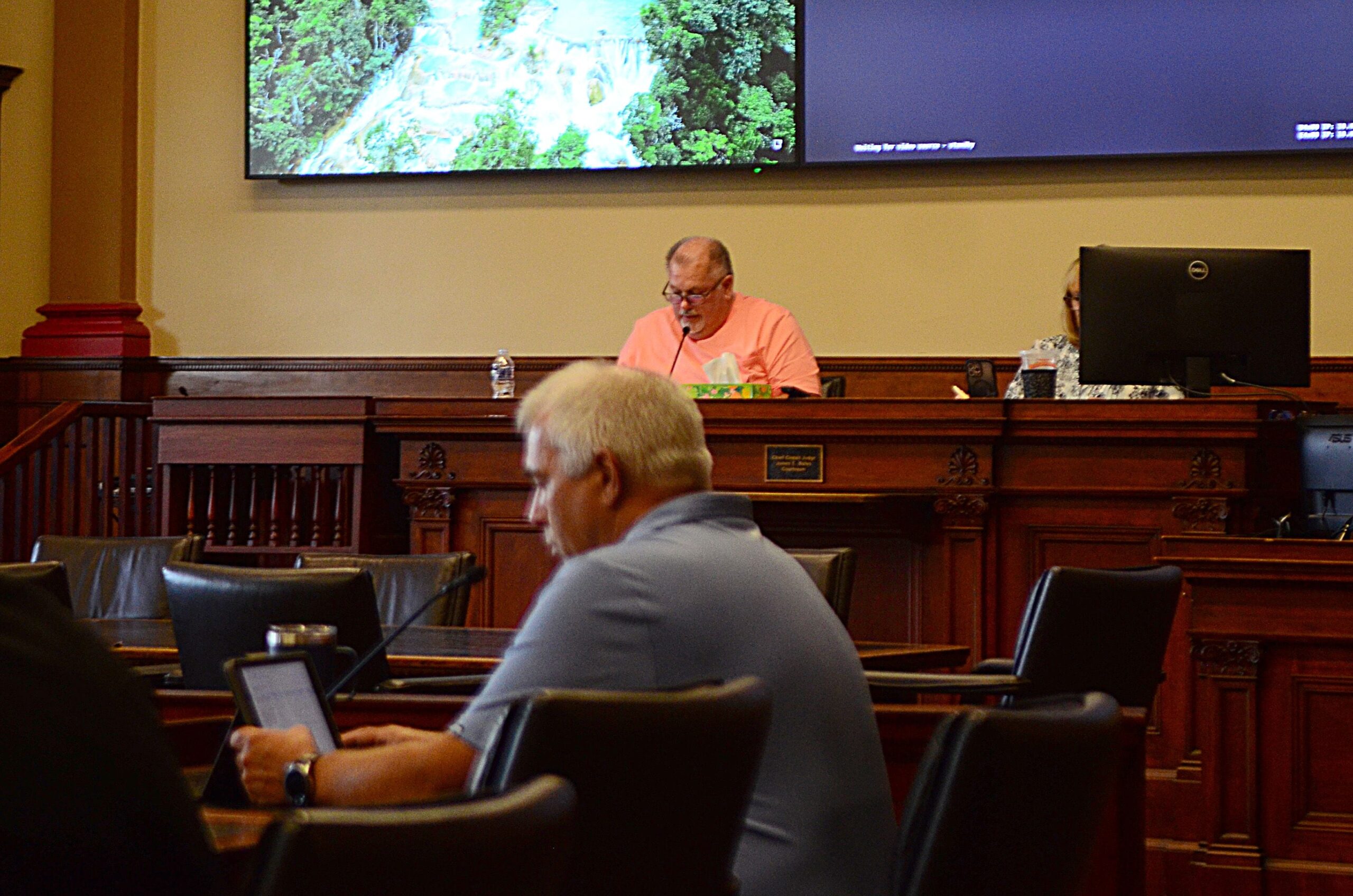

The Lee County Board voted on October 23, 2023, to approve the 2025 property tax levy and the fiscal 2026 budget during a meeting that saw nearly unanimous support. The approved property tax rate for 2025 will be set at 82.42 cents per $100 of equalized assessed value, which marks an increase from the 2024 rate of 79.46 cents. This adjustment is expected to raise estimated tax bills by $13.03 for homeowners with properties valued at $150,000.

The total amount requested for the 2025 tax levy stands at $9,904,565, reflecting an increase of $441,506 or 4.67% compared to the previous year. The fiscal 2026 budget, which aligns with state law requirements, is balanced, meaning expenditures will match revenues.

Implications for Lee County Residents

Property taxes in Lee County will be billed for the 2025 calendar year, with payments due in fiscal 2026, covering the period from December 1, 2025, to November 30, 2026. According to Lee County Financial Director Reid Mitchell, the individual tax amounts are calculated based on the property’s equalized assessed value and the tax rate set by various taxing bodies.

Mitchell noted that changes in property assessments could lead to fluctuations in individual tax bills. “A resident’s bill could go up or down depending on how your assessed value changed,” he explained. It is important to note that Lee County typically accounts for approximately 10% of the total property tax bill, with various other taxing authorities setting their own levies. For instance, on a typical bill from a property in Dixon, around 54% comes from the Dixon Public Schools District 170, while the city contributes around 24%.

Encouraging Community Engagement

During the meeting, all board members present voted in favor of the budget, with the exception of board member Mike Koppien, who opposed the tax levy. Board members Chris Norberg, Mike Book, and Jennifer Dallas were absent from the vote. The approval process included a standard practice of placing both ordinances on file to allow residents the opportunity to voice their opinions.

In light of the changes, Jeremy Englund, Lee County Administrator, urged residents to reach out with any questions or concerns regarding their property tax bills. “We are doing our best to look at the impact to our residential tax base, and we’re trying to limit that as much as possible,” he emphasized. Residents can contact the county office at 815-288-5676 for more information.

-

Politics3 weeks ago

Politics3 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025