Top Stories

UK Budget Hits High Earners Hard: Tax Increases Announced

UPDATE: The UK’s Labour government budget, unveiled by Chancellor of the Exchequer Rachel Reeves on Wednesday, is set to deliver a significant financial blow to the nation’s highly paid professionals. As the government prepares to increase taxes and adjust welfare payments, the impact on doctors, lawyers, bankers, and tech workers across major cities will be felt hard, with many facing a stark reality check on their personal finances.

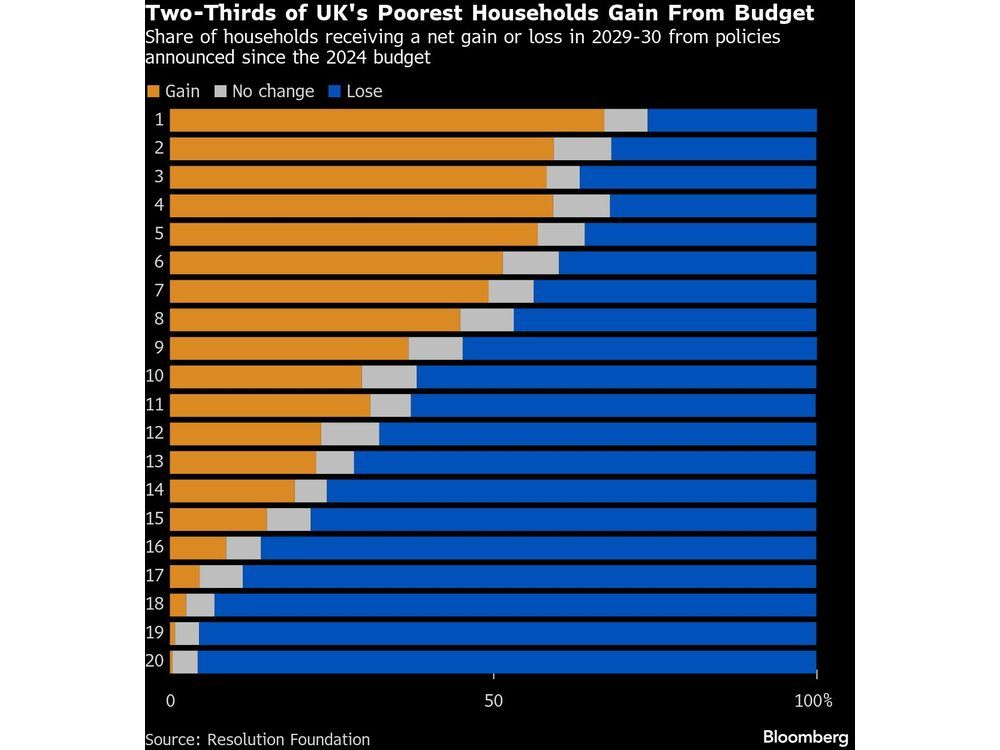

The budget, which has been described as “a Labour budget demonstrating Labour values” by Prime Minister Keir Starmer, aims to redistribute wealth but will particularly affect the top 20% of earners. Analysis from the Resolution Foundation indicates that by the end of the decade, households in this income bracket will lose more than £1,000 ($1,324) annually, while the top 5% could see reductions exceeding £2,000.

This budget is more than just numbers; it represents a shifting landscape for middle to higher earners in the UK. According to Scott Tindle, director of TindleWealth, “Middle to higher-earners are probably getting hit harder than anybody with this budget.” He notes that taxes on everything from electric vehicles to investment income are set to rise, adding pressure on those already struggling with high living costs in urban areas.

One of the professionals feeling the pinch is Greg Simkins, a 37-year-old business developer in Birmingham. He laments the freeze on personal tax thresholds, stating, “It’s a disincentive to earn more,” echoing the concerns of many who fear the long-term effects on economic growth and personal ambition.

The budget aims to fund initiatives such as the abolition of the two-child benefit cap and relief on rising energy bills, but it does so at a cost. Tom Waters, associate director at the Institute for Fiscal Studies, highlighted that the wealthiest will shoulder the bulk of tax increases, but warned, “We are seeing a giveaway next year, in the short run, but that will be compensated by a takeaway in the longer run through higher taxation for middle and particularly higher income households.”

The implications of the budget are profound. Nearly one million additional workers will be pushed into higher income tax brackets, with close to 25% of taxpayers projected to fall into the top two bands by 2030/31, a significant increase from 15% in the 2021-22 fiscal year.

As personal finances tighten, many professionals are contemplating their futures in the UK. Anecdotal evidence suggests that high earners, including doctors and teachers, are considering leaving the country. Ollie Saiman, co-founder of wealth manager Six Degrees, stated, “Everyone’s talking about the super rich leaving the UK or entrepreneurs leaving the UK.”

With the government aiming to raise the tax take to a record high of 38% of economic output by the end of the decade, the question remains: How will these changes affect the morale and productivity of the UK’s aspiring professionals?

Harry Arnold, a 37-year-old financial adviser earning around £100,000 a year in south London, expressed his discontent: “You literally are quite a bit poorer than you would’ve been.” His concerns reflect a broader sentiment that this budget may not only dampen individual prospects but also hinder economic growth.

As the UK braces for these fiscal changes, the immediate impact on high earners will be significant. Stay tuned for further updates as this story develops, and watch for reactions from professionals grappling with the realities of a changing financial landscape.

-

Politics3 weeks ago

Politics3 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025