Top Stories

Urgent: Youth in Nunavut Learn Financial Literacy Amid Banking Barriers

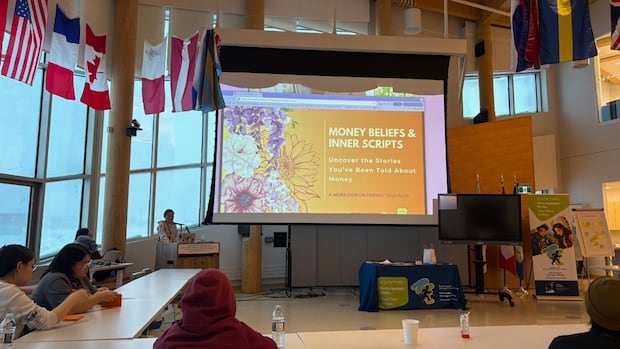

UPDATE: Youth in Cambridge Bay, Nunavut, are gaining crucial financial skills at a three-day camp hosted by the Makigiaqta Inuit Training Corporation. This initiative addresses significant barriers faced by Indigenous youth in accessing banking services.

Just last month, financial educator Tupaarnaq Kopeck and local advocate Juutai McKitrick guided participants through the complexities of financial literacy. Many young attendees, particularly those from remote communities, expressed their eagerness to learn, despite not having access to personal bank accounts. “A lot of the stuff I’m teaching would be good for them to actually go back home and use these teachings in real life,” Kopeck stated, highlighting the urgent need for practical financial education.

In Canada, approximately 15% of Indigenous people are classified as “unbanked,” compared to just 2% of the overall Canadian population. This disparity is starkly visible in Nunavut, where towns like Iqaluit have multiple banking options, while smaller communities often lack even one bank. McKitrick emphasizes the broader community impact, explaining, “If there’s banking services, someone can use those to open a business, benefiting everyone.”

This pressing issue of banking accessibility is compounded by unique geographical challenges. Many Inuit communities do not have registered street addresses, forcing residents to rely on P.O. boxes for their mail. This creates obstacles when applying for bank accounts, as many banks do not accept P.O. boxes as valid addresses.

The camp, held in early November, aims to equip youth with the knowledge needed to navigate these challenges effectively. McKitrick is advocating for solutions, such as registering street addresses and providing banking services at local post offices. The urgency of this initiative is underscored by the ongoing struggles of many young people in Nunavut.

In response to these challenges, financial institutions are stepping up. Kathleen Gomes, branch manager at the First Nations Bank in Iqaluit, stated that their recent Igloolik branch opening aims to enhance accessibility. “Even if there is no physical bank in a community, people can still open accounts online,” she noted, emphasizing the importance of digital solutions.

Both RBC and CIBC have committed to supporting financial education in Indigenous communities. RBC has stated that they are dedicated to reaching young people where they are, while CIBC offers remote meeting options for clients unable to visit in-person locations.

Kopeck encourages youth to utilize online resources and seek help from knowledgeable community members when navigating financial services. “There is lots that they can do on their own at home, on their computer,” she advised. “If there is someone in your community that you know is really good with money, just ask them.”

As this initiative unfolds, the potential impact on youth in Nunavut’s communities is profound. The financial literacy skills taught at the camp could empower a new generation to overcome systemic barriers and foster economic growth, benefiting not just individuals but entire communities.

Stay tuned for further updates on this developing story as more youth in Nunavut gain essential financial skills to navigate their banking challenges.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025