Education

Empower Your Child’s Future: Save for Education with Embark

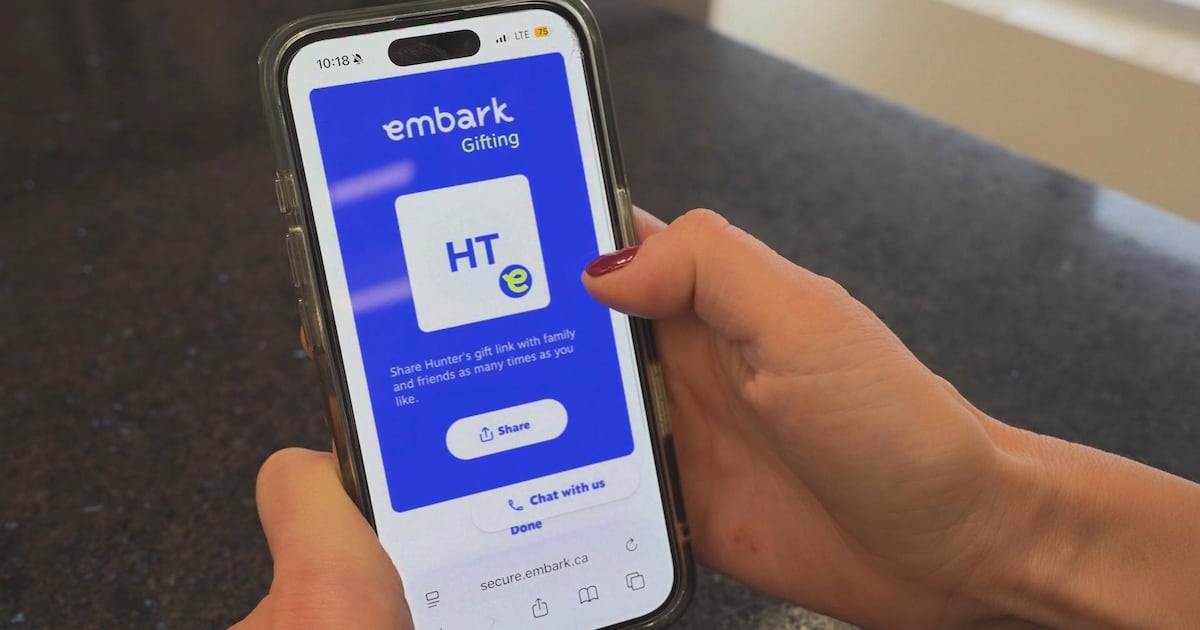

In a significant move to support families in planning for their children’s education, a family lifestyle expert has outlined a straightforward method for saving using the service provided by Embark. This initiative aims to alleviate the financial burden associated with higher education, which has become increasingly daunting for many parents.

The rising costs of education can be overwhelming. According to recent statistics, the average tuition fee for post-secondary education in Canada has reached approximately $6,500 per year, which translates to a staggering $100,000 for an 18-year education plan, including living expenses. Many families are seeking effective strategies to save for these expenses, and Embark offers a viable solution.

How Embark Simplifies Education Savings

Embark provides an innovative online platform that allows parents to set up dedicated education savings plans. This service is designed to be user-friendly, enabling families to contribute regularly and track their progress over time. The platform also offers personalized financial advice to help families choose the best savings options based on their unique circumstances.

The family lifestyle expert emphasized the importance of starting early. By beginning to save when children are young, families can maximize their savings through compound interest. Even small, regular contributions can accumulate significantly over the years. For instance, saving just $250 monthly from a child’s birth could result in over $50,000 by the time they reach 18, depending on interest rates.

Accessible Options for Every Family

Embark caters to a diverse audience, making it accessible for families from various backgrounds. The platform is designed to adapt to different financial situations, ensuring that every parent can participate in their child’s education savings plan. The expert noted that even modest contributions can make a substantial difference in the long run.

Parents interested in learning more about how to set up an account or explore their options can visit the official website at www.embark.ca. The platform also includes resources that educate families about the benefits of early savings and the various financing options available for post-secondary education.

In conclusion, the initiative spearheaded by Embark represents a proactive approach to tackling the rising costs of education. By providing an accessible platform for savings, families can better prepare for the financial demands of their children’s future education. As education expenses continue to climb, taking steps now can pave the way for a brighter future for the next generation.

-

Politics1 month ago

Politics1 month agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Technology4 months ago

Technology4 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Top Stories2 weeks ago

Top Stories2 weeks agoHomemade Houseboat ‘Neverlanding’ Captivates Lake Huron Voyagers

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit