Business

REITs Offer Promising Growth Opportunities for Investors

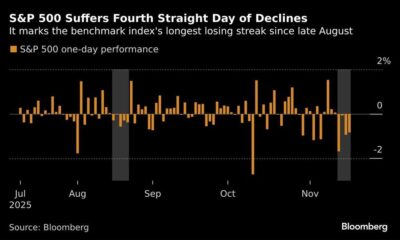

Investors often perceive Real Estate Investment Trusts (REITs) as stable income sources with limited growth potential. Contrary to this belief, recent analyses indicate that REITs can serve as total return investments, offering significant capital appreciation alongside income generation. As of July 2025, these investment vehicles have even demonstrated superior performance compared to the S&P 500.

Jussi Askola, the President of Leonberg Capital, a boutique investment firm specializing in value-oriented strategies, emphasizes the potential of REITs for substantial returns. His firm dedicates considerable resources—over $100,000 annually—toward researching profitable investment opportunities in the real estate sector. Askola’s expertise is further validated by his experience in authoring award-winning academic papers on REIT investing and successfully passing all three CFA exams.

Askola’s insights highlight the need for a shift in perspective regarding REITs. Investors often overlook the growth potential due to a focus on the income aspect. “REITs should be viewed as a blend of growth and income,” he notes. The combination of property appreciation and dividend returns can yield impressive total returns for investors willing to recognize their full potential.

Maximizing Returns in Real Estate

Investors interested in optimizing their portfolios can find valuable recommendations in the latest investment picks released for July 2025. By joining Leonberg Capital’s platform, investors gain immediate access to curated opportunities that aim to maximize returns in the real estate market. The firm has garnered over 500 five-star reviews from satisfied clients, indicating a strong track record of success.

Additionally, Askola maintains a beneficial long position in the shares of CLPR and AHH through various financial instruments. This positions him as both an analyst and investor, reinforcing his credibility in the sector. He asserts, “Our approach allows clients to leverage our extensive research and insights at a fraction of the cost, ensuring they are well-equipped to make informed decisions.”

While it is crucial for potential investors to consider risks associated with any investment, including REITs, past performance in this sector has shown resilience and adaptability. As the market evolves, REITs can provide an avenue for diversification and growth, aligning with broader financial goals.

Understanding the Landscape

The investment landscape is continually changing, and REITs represent a unique opportunity for both seasoned and novice investors. However, it is essential to approach these investments with a clear understanding of their dynamics. According to Seeking Alpha, past performance is not indicative of future results, and investors should conduct thorough research before making decisions.

Leonberg Capital’s commitment to education and analysis positions it well to guide clients through the complexities of REIT investing. By fostering an environment of informed decision-making, Askola and his team aim to reshape perceptions about the growth potential of REITs.

In conclusion, while REITs have often been dismissed as conservative investments, their capacity for total returns should not be underestimated. As evidenced by the insights from industry experts, investing in REITs can yield significant benefits for those willing to embrace their full potential.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025