Sports

Major Banks Report Q2 Earnings Amid Tariff Concerns

Major U.S. banks, including JPMorgan Chase, Wells Fargo, and Citigroup, are set to release their second-quarter earnings today, potentially revealing the financial impact of ongoing trade tensions. Investors are particularly focused on these results as they reflect broader economic conditions influenced by recent tariff policies.

According to data from LSEG, profits for companies in the S&P 500 are projected to increase by 5.8% in the second quarter. This figure marks a significant decrease from the initial forecast of 10.2% made on April 1, before the trade war initiated by former U.S. President Donald Trump escalated. The anticipated earnings will provide insight into how these tariffs are affecting corporate profitability.

Investor Focus on Inflation Data

In addition to bank earnings, investors are awaiting the release of U.S. consumer price data for June. This data will be scrutinized for indications of price pressures stemming from tariffs, which could influence future policy decisions by the Federal Reserve. Analysts are particularly interested in understanding how inflation trends might affect the central bank’s approach to interest rates in the coming months.

The interplay between corporate earnings and inflation data is crucial as businesses navigate the impacts of trade policies. With increased costs potentially passed on to consumers, the results from these major banks may offer clues to the overall health of the economy.

As the financial landscape continues to evolve, the upcoming earnings reports and consumer price index findings are expected to shape market expectations and inform investment strategies. Investors and analysts alike remain alert to how these developments will unfold and what they will mean for economic growth in the United States.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

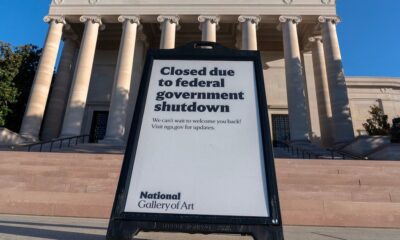

Politics1 week ago

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns