Top Stories

Trump’s Financial Penalties Target Oil Buyers India and China

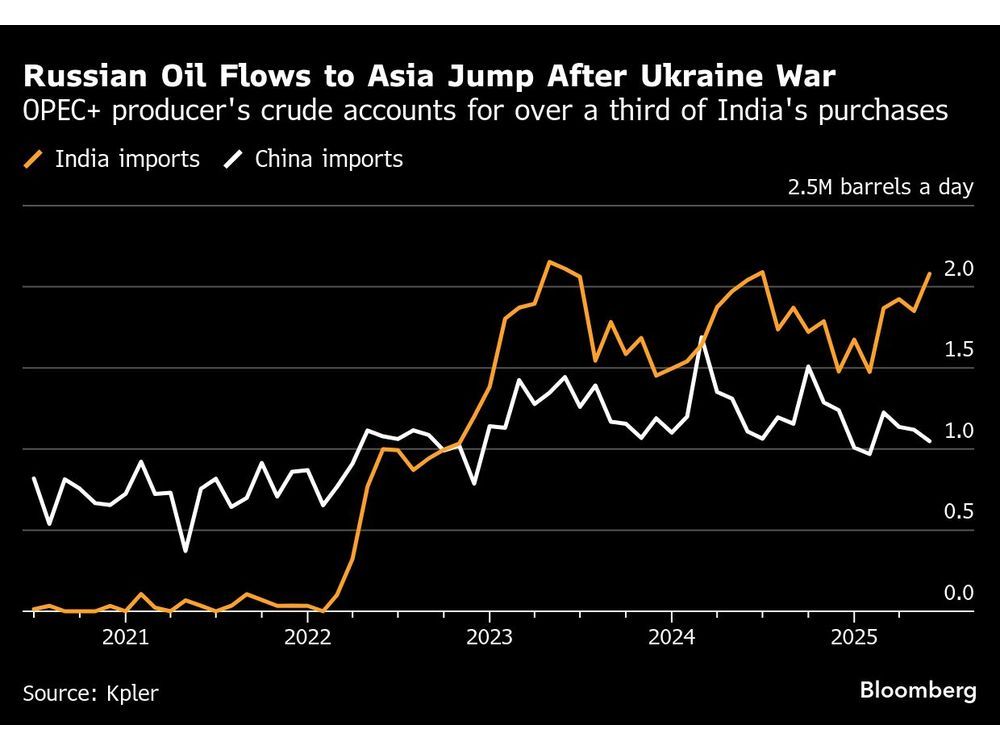

President Donald Trump has announced potential financial penalties against Russia, drawing attention to the significant role of India and China as primary buyers of Russian crude oil. Since the onset of the war in Ukraine in early 2022, India has emerged as a major importer, with more than a third of its oil purchases coming from Russia this year. This is a stark contrast to the less than 1% imported prior to the conflict, according to data from Kpler.

China’s imports have also increased during this period, indicating a continued reliance on Russian oil. Despite the escalating rhetoric from the U.S. government, markets reacted with skepticism. The global benchmark for crude oil, Brent, fell nearly 2% to close below $70 a barrel on Monday, reflecting a lack of immediate concern regarding potential disruptions in oil supply.

Trump’s proposed penalties, which he described as “secondary tariffs,” would take effect in 50 days unless Russia ceases its military actions in Ukraine. Matt Whitaker, the U.S. ambassador to NATO, emphasized that these tariffs would essentially act as sanctions against nations purchasing Russian oil, with a particular focus on India and China.

In June, Russian oil deliveries to India peaked at 2.1 million barrels per day, marking the highest intake in nearly a year and nearing the record set in May 2023. While China’s imports have not surged at the same rate as India’s, they have consistently exceeded 1 million barrels per day since the start of the conflict.

Market Reactions and Future Projections

Analysts note that while India may face challenges if it is unable to procure Russian crude, it has options among other OPEC members. Mukesh Sahdev, head of commodity markets at Rystad Energy A/S, stated that if India is cut off from Russian supplies, it could turn to the Middle East and Africa to fill the gap. However, he cautioned that this would likely come at a higher cost.

Data from India’s Ministry of Commerce and Industry reveals that imports from Saudi Arabia were priced at $5 more per barrel than those from Russia in May, while Iraqi shipments were approximately 50 cents pricier. This price differential could put pressure on India’s economy as it navigates the implications of the U.S. sanctions.

As global oil dynamics shift, the long-term impact of Trump’s threats on Russian oil buyers remains uncertain. The evolving landscape will require careful monitoring, particularly as India and China continue to play pivotal roles in the international oil market. The geopolitical implications of these developments may influence not only energy prices but also the broader economic relationships among countries.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025