Sports

Bank of Canada Maintains Interest Rate at 2.75% Amid Economic Stability

The Bank of Canada is expected to keep its key interest rate steady at 2.75% during its upcoming announcement on July 26, 2023. This decision marks the third consecutive meeting where the central bank has opted to maintain rates, as stable core inflation and strong job growth reduce the urgency for monetary easing.

Economic indicators suggest a more stable environment, easing concerns surrounding the impact of tariffs imposed by former President Donald Trump. Doug Porter, chief economist at BMO Capital Markets, noted, “Core inflation is still a little bit hot for the Bank of Canada’s comfort.” He added that recent economic data has shown less negative performance than expected, increasing the likelihood of a sustained pause in interest rates.

The job market has shown signs of recovery, with the economy adding 83,100 new jobs in June, marking the first net increase since January. This uptick brought the unemployment rate down to 6.9%. Growth was particularly noted in sectors such as wholesale and retail trade, manufacturing, and healthcare, indicating a broadening recovery.

Core inflation remains a critical focus for the Bank of Canada, with measures consistently above 3%, exceeding the bank’s target range of 1%-3%. According to David Doyle, head of economics at Macquarie, “The Bank of Canada, being a single mandate central bank, cares about inflation the most.”

Market expectations reflect a 7%-8% probability of a rate cut during this meeting. A recent Reuters poll involving 28 economists revealed that uncertainties surrounding tariffs and the latest inflation and employment data would likely keep the Bank of Canada on hold this week. Among those surveyed, nearly two-thirds anticipate a 25 basis points cut to 2.50% in September, with over 60% predicting a second cut before the end of the year.

The Bank of Canada has been proactive in its monetary policy, initiating rate cuts in June of last year, becoming the first central bank in the G7 to do so. Since that time, it has reduced rates by a total of 225 basis points from June 2022 to March 2023.

Tiff Macklem, Governor of the Bank of Canada, will reveal the governing council’s decision at 9:45 a.m. ET (1345 GMT) on Wednesday. Alongside this announcement, the bank will release its quarterly monetary policy report, which typically includes projections on both the economy and inflation.

The Bank of Canada altered its approach in April, for the first time since the pandemic, by presenting two distinct economic scenarios due to ongoing uncertainties surrounding tariffs. Doyle expressed cautious optimism, stating, “Things are still tremendously uncertain, but it feels like the uncertainty has come down a little bit since then.” He added that he would be surprised if the bank did not provide formal forecasts in its upcoming report.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

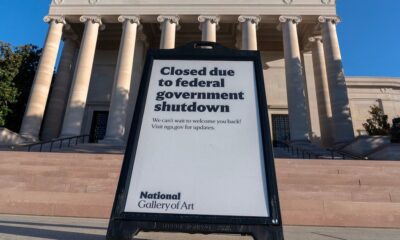

Politics1 week ago

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns