Top Stories

South Korea’s $350B US Fund to Focus on Loans, Not Equity

URGENT UPDATE: South Korea confirms its ambitious $350 billion investment pledge as part of a new trade deal with the United States will primarily consist of loan guarantees, not direct equity. In a crucial announcement made during a televised interview on October 15, 2023, Senior Presidential Policy Director Kim Yong-beom revealed that the actual equity commitment would remain below 5%, addressing growing domestic concerns over the agreement’s potential risks.

Kim emphasized that this fund is designed to back only commercially viable projects in the U.S., clarifying, “This isn’t about financing everything unconditionally, but about investing in projects that are commercially viable.” He indicated the fund is structured as a “credit guarantee ceiling,” with critical support from state-backed institutions like the Export-Import Bank of Korea and the Korea Trade Insurance Corp..

The announcement follows a recent trade deal reached last week by President Lee Jae Myung’s administration, which capped tariffs on South Korean exports to the U.S. at 15%. This move averted a potentially devastating 25% import levy that could have significantly harmed South Korea’s export-dependent economy, where exports account for over 40% of GDP.

Under the new fund structure, $150 billion is earmarked for the shipbuilding initiative dubbed MASGA—Make American Shipbuilding Great Again—where South Korea expects to take a leading role. The remaining $200 billion will target strategic U.S.-based projects in sectors such as semiconductors, batteries, and nuclear energy.

Critically, Kim outlined that the Korean government will not approve financing for every U.S. project proposed. “Only projects that are commercially reasonable and viable will receive backing,” he stated, underscoring the stringent criteria that have been documented in formal agreements.

Additionally, Kim indicated that profits generated from the fund are likely to be reinvested in the U.S. rather than repatriated immediately, which he believes could ultimately benefit Korean firms involved in those projects. “If profits are generated, it means the project was successful — and that opens the door for second and third rounds of investment,” he said.

Separately, he dismissed rumors that South Korea had agreed to open its rice or beef markets as part of the broader deal, noting that while there could be discussions about technical adjustments, no financial burden would be placed on the public.

Kim also pointed to the changing landscape of global trade, stating, “This is not just about responding to external pressure. It’s time we start a domestic dialogue about how to address these issues on our own terms.”

As these developments unfold, the impact on both South Korean and U.S. economies will be closely monitored. The focus will now shift to how effectively the fund can support strategic sectors while mitigating risks associated with significant financial commitments.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

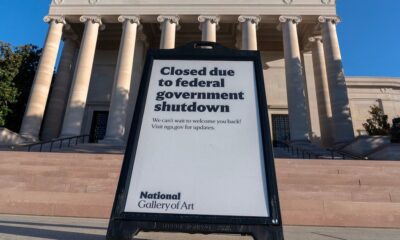

Politics1 week ago

Politics1 week agoShutdown Reflects Democratic Struggles Amid Economic Concerns