Top Stories

Trump Doubles Tariffs on India, Threatens Oil Supply Chain

URGENT UPDATE: The United States has just announced a 25% increase in tariffs on Indian goods, directly targeting India’s ongoing purchases of discounted Russian oil. This decision leaves India, the world’s third-largest oil consumer, facing significant economic repercussions and puts Prime Minister Narendra Modi in a precarious position as he navigates geopolitical tensions.

The newly imposed tariffs come as Modi’s government grapples with an oil import bill that has ballooned amidst rising prices and complicated international relations. While India saved approximately $3.8 billion in the last fiscal year on Russian crude, it exported around $87 billion worth of goods to the US in 2024, making the stakes incredibly high.

In a blunt warning, US President Donald Trump stated that India must stop “fueling the war machine” by purchasing Russian oil, pushing for an urgent rethink of its energy strategy. This pressure could jeopardize India’s long-standing relationship with Moscow, which extends well beyond oil imports, as Modi faces mounting domestic pressure to maintain that vital connection.

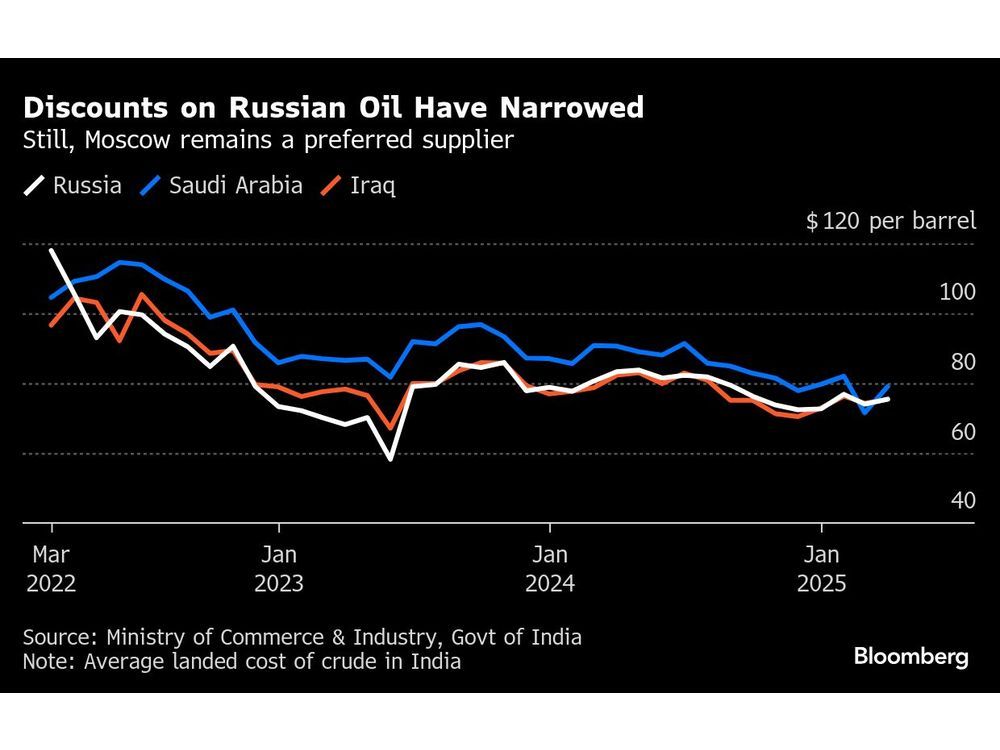

Industry insiders report that Indian refiners like Indian Oil Corp. and Bharat Petroleum Corp. are already shifting gears, seeking alternative oil sources from Saudi Arabia and the United States amidst fears of US backlash. The refiners, which typically relied heavily on Russian crude, are now navigating a rapidly changing market landscape.

According to experts, the likelihood of India completely severing ties with Russian oil is minimal. “It’s very, very unlikely that Indian oil imports from Russia will go to zero,” said Vandana Hari, founder of consultancy Vanda Insights. “The geopolitical ramifications are significant, and India will not easily give up its relationship with Russia.”

As of March 2024, Russian crude makes up around 37% of India’s total oil imports, a dramatic increase from previous years. This surge began post-2022, following the invasion of Ukraine and the implementation of a $60-per-barrel price cap by the Group of Seven nations aimed at limiting Kremlin revenues while ensuring global supply continuity.

Indian officials are warning that a full withdrawal from Russian oil could lead to a spike in global oil prices, recalling the dramatic price increases of 2022. The current oil market, however, is relatively stable, trading under $70 per barrel, allowing India some room to maneuver away from Russian crude if necessary.

What happens next is crucial. As Indian refiners approach Middle Eastern producers for long-term contracts, the political ramifications of Trump’s tariffs will likely continue to unfold. Will Modi yield to US pressure or maintain India’s strategic energy ties with Russia?

The world is watching closely as India balances its economic interests against rising geopolitical tensions. As the situation develops, oil markets and international relations could face significant shifts, impacting global economies and energy prices.

Stay tuned for more updates on this developing story.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025