Business

Labour Faces Financial Crisis: History Warns Against Austerity

Britain is grappling with a potential financial crisis that threatens to escalate rapidly. Media reports, opposition parties, and financial experts are increasingly voicing concerns about the nation’s economic stability under the Labour government. The discourse revolves around a looming bankruptcy, attributed primarily to excessive state spending, particularly on welfare programs.

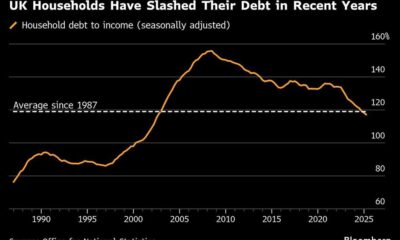

Prominent voices, such as Matthew Parris, have suggested drastic reforms, with Parris recently stating that the welfare state is “in danger of toppling the whole economy.” His comments reflect a broader sentiment that rising numbers of claimants are exacerbating an already fragile fiscal situation. According to the Office for Budget Responsibility (OBR), public debt is at its highest level since the early 1960s, projected to surpass 270% of GDP by the early 2070s as costs from an ageing population escalate.

This autumn, Chancellor Rachel Reeves will likely present a budget amidst rising financial anxiety. The historical context is stark: past Labour governments have faced similar fiscal pressures, notably in 1931, during the Great Depression, and in 1976, when the UK sought a loan from the International Monetary Fund. Each time, Labour responded with austerity measures, a strategy that has consistently led to electoral losses.

As summer wanes, the public’s mood often turns to economic concerns, making them susceptible to dire forecasts about government borrowing. Yet, there is a notable lack of scrutiny regarding the underlying political motives driving these austerity narratives. When commentators assert that Britain “can’t afford” certain expenditures, they seldom include military spending or the costs associated with royal family support.

The dialogue surrounding austerity often neglects the detrimental effects of previous cuts on public services, which have already adversely affected productivity and social stability. Many commentators appear surprised by the impoverished state of public services, indicating a disconnect between political rhetoric and the lived realities of citizens. This detachment suggests a lingering influence of Thatcherism, with many believing that reducing government support is the solution to economic woes.

Labour’s historical responses to fiscal crises have typically involved cuts, a trend that persists today. The party’s past experiences illustrate a pattern where Labour attempts to project fiscal responsibility, only to find itself trapped in a cycle of austerity that alienates voters. During the aftermath of the 1976 crisis, Chancellor Denis Healey later discovered that the financial forecasts provided to him were overly pessimistic, suggesting a systemic bias within the Treasury towards advocating for spending cuts.

As the situation evolves, the National Institute of Social and Economic Research has warned that the Chancellor cannot simultaneously adhere to fiscal rules, fulfill spending commitments, and avoid raising taxes for working people. One of these priorities will likely need to be sacrificed.

Global financial markets, increasingly interconnected and unforgiving, will scrutinize Labour’s next moves with a critical eye. The challenge for the Labour Party is to break free from the long-standing belief that progressive policies and support for the disadvantaged must be the first victims of economic hardship.

Labour may benefit from re-examining past austerity advocates, such as George Osborne and Kemi Badenoch, questioning whether the country can afford a repeat of such “haughty, socially disastrous politics.” However, articulating an alternative vision of centre-left politics that can withstand financial crises remains a daunting task.

After years of cautious retreat in the face of financial challenges, the Labour Party’s work in redefining its approach to economic governance has only just begun. The coming months will be crucial in determining how the party navigates these treacherous waters while remaining connected to the needs of its constituents.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025