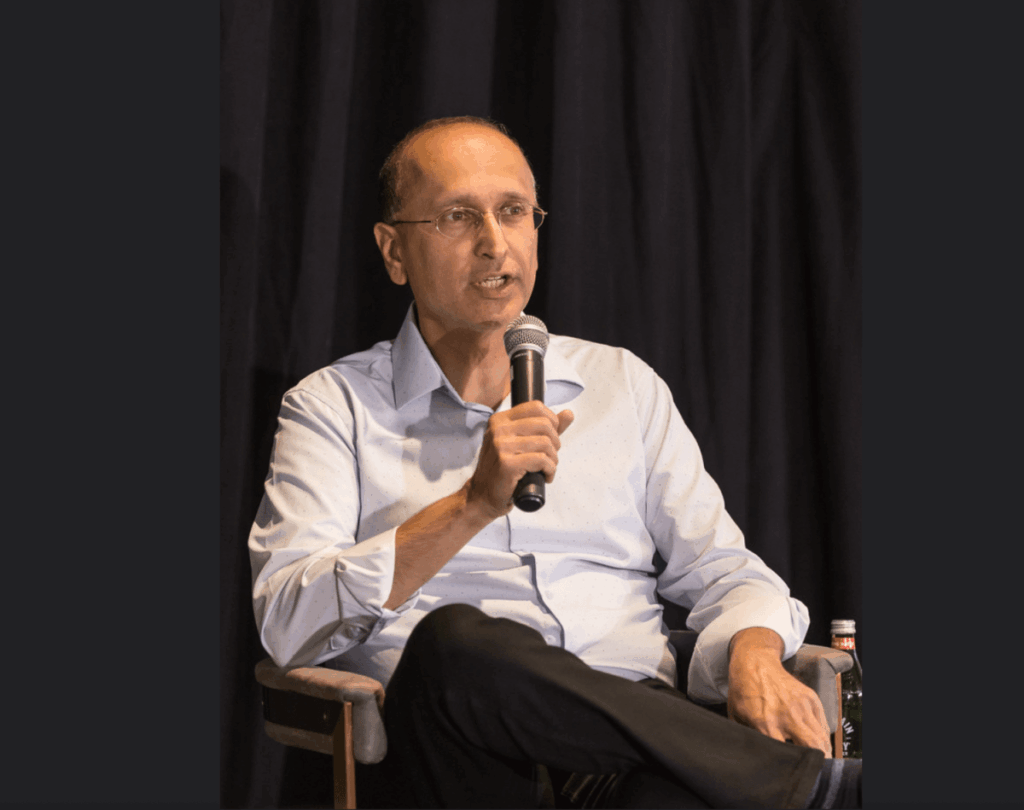

Navin Chaddha, managing director of the renowned Silicon Valley venture firm Mayfield, is placing a significant wager on artificial intelligence (AI) to revolutionize industries traditionally reliant on human labor, such as consulting, law, and accounting. Speaking at TechCrunch’s StrictlyVC event in Menlo Park, Chaddha shared his vision of “AI teammates” transforming these sectors into ones with software-like margins. He advised startups to target underserved markets rather than directly competing with industry giants like Accenture, acknowledging the challenges in disrupting sectors where relationships and trust are paramount.

Chaddha’s insights are rooted in his extensive experience with Mayfield, a firm that has witnessed technological shifts from mainframes to the current AI era. He draws parallels with past trends like the rise of e-business in the late ’90s and the subsequent outsourcing boom. According to Chaddha, AI represents a “100x force” that will not only enhance human capabilities but also fundamentally reimagine business operations.

The AI Transformation in Consulting

Chaddha envisions AI reshaping the $5 trillion market of law firms, consulting companies, and accounting services. He argues that AI-first companies can achieve software-like margins by automating repetitive tasks, allowing humans to focus on more complex responsibilities. He cites the implementation of Salesforce as an example where AI can handle routine tasks, with humans stepping in only when necessary.

Chaddha suggests a strategic approach for startups: instead of challenging established giants, they should serve the “neglected masses.” This includes millions of small companies in the U.S. and worldwide that cannot afford traditional knowledge workers. By offering services as software, startups can charge based on outcomes rather than time, aligning with cloud and utility billing models.

Case Study: Gruve’s Success Story

Chaddha recently led a Series A funding round for Gruve, an AI tech consulting startup. Gruve’s founders, experienced in building successful services companies, acquired a security consulting firm and rapidly increased its revenue from $5 million to $15 million within six months, achieving an 80% gross margin. This outcome-based model has been well-received by clients like Cisco, who appreciate the cost-effectiveness and efficiency of AI-driven services.

“Customers love it. Cisco loves it. They say, ‘Hey, I’m not getting hacked. Why am I paying for all these security people?'”

The Innovator’s Dilemma

Chaddha acknowledges that established firms like McKinsey and Accenture face the innovator’s dilemma. These companies are entrenched in traditional business models and may struggle to transition to AI-driven, outcome-based models. He advises startups to capitalize on this opportunity by serving markets that these giants cannot easily penetrate.

However, Chaddha predicts that in the long term, even the largest consulting firms will be compelled to adopt AI models to remain competitive. The shift from predictable revenue streams to utility-based revenue will be challenging but necessary for survival.

The Role of AI Teammates

Mayfield has earmarked $100 million for investment in “AI teammates,” which Chaddha defines as digital companions collaborating with humans on shared goals. These AI teammates are not intended to replace humans but to enhance their capabilities, leading to better outcomes.

Chaddha acknowledges the potential for job displacement but remains optimistic about the long-term benefits of AI. He draws parallels with past technological advancements, such as the introduction of Microsoft Word and Excel, which initially raised fears of job losses but ultimately expanded markets and created new opportunities.

“When Microsoft Word came to PCs on the desktop, people thought [executive assistants] were out of business. Then Excel came, and accountants who did calculations — everyone thought they were out of business.”

Investment Strategies in the AI Era

Chaddha emphasizes the importance of having a clear investment strategy and avoiding the fear of missing out (FOMO). He likens successful investing to an art form, honed through experience and discipline. He cautions that while significant profits can be made during this technological shift, many investors may struggle without a solid understanding of the market dynamics.

As AI continues to evolve, Chaddha remains bullish on its potential to transform industries and create new opportunities. His insights offer a roadmap for startups and investors looking to navigate the complexities of the AI-driven future.