Business

BP Surpasses Q2 Profit Projections as CEO Pledges Improved Returns

BP has exceeded profit expectations for the second quarter of 2025, reporting an underlying replacement cost profit of $2.4 billion. This figure, though lower than the $2.76 billion recorded during the same period in 2024, significantly surpassed analyst estimates of $1.82 billion. Chief Executive Officer Murray Auchincloss affirmed that the company is committed to enhancing returns for its investors.

The energy giant’s Q2 performance represented a notable improvement from the first quarter of this year, where earnings had struggled. Factors contributing to the $1 billion increase in underlying profit included favorable gas marketing and trading outcomes, improved refining margins, and stronger earnings from the customers division. While these gains were tempered by lower revenues from liquids and gas and higher refinery turnaround activities, they nonetheless reflect a positive trend for BP.

Dividend and Share Buyback Initiatives

Alongside its profit report, BP announced an increase in its dividend per ordinary share to 8.32 cents, marking a 4% rise. The company also revealed plans for a $750 million share buyback in the second quarter, further demonstrating its commitment to returning value to shareholders.

In the earnings release, BP addressed ongoing efforts to streamline operations and achieve structural cost savings. The company is targeting $4 billion to $5 billion in reductions by the end of 2027, using 2023 as a baseline. So far, BP has achieved structural cost reductions of $900 million in the first half of 2025, totaling $1.7 billion in cuts against the 2023 baseline.

Commitment to Improvement

Auchincloss expressed confidence in the company’s trajectory, stating, “We are two quarters into a twelve-quarter plan and are laser-focused on delivery of our four key targets. While we should be encouraged by our early progress, we know there’s much more to do.”

He and the newly appointed chair, Albert Manifold, have committed to conducting a comprehensive review of BP’s business portfolio. Auchincloss emphasized that while safety remains paramount, the company aims to be “best in class” within the industry. “BP can and will do better for its investors,” he asserted, reinforcing the company’s dedication to improving performance in the coming quarters.

In light of these developments, BP is positioning itself to meet the demands of its stakeholders while navigating the complexities of the global energy market. The proactive approach to cost management and strategic planning may play a crucial role in sustaining investor confidence amidst an evolving economic landscape.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

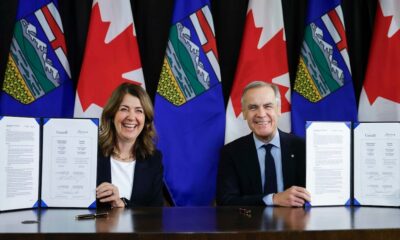

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025