Business

Broadcom Faces Pressure as AI Hype Outpaces Actual Growth

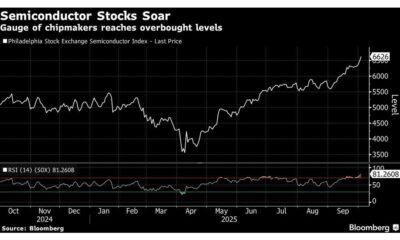

Broadcom Inc. has experienced significant market enthusiasm driven by the artificial intelligence (AI) sector, yet its current valuation suggests an inflated perception of its growth potential. The company reported a modest 22% growth in its fiscal third quarter of 2025, while its competitor, Nvidia, achieved an impressive 200% growth last year. This stark contrast highlights the disparity in market sentiment between the two firms.

Despite securing a substantial $10 billion chip deal, Broadcom’s stock trades at a higher earnings multiple than Nvidia, which continues to be recognized as the leader in AI technology. Investors are increasingly concerned that Broadcom’s valuation may be unsustainable if the current AI boom begins to cool. The market has assigned a steep premium to Broadcom based on its perceived potential in AI infrastructure, raising questions about the long-term viability of such high expectations.

Market Dynamics and Future Outlook

Broadcom’s position as a key supplier for AI technologies is solid; the company manufactures chips for several prominent players in the AI space. However, the growth trajectory it has demonstrated does not align with the market’s inflated expectations. Analysts express concern that if the AI sector experiences a slowdown, Broadcom’s stock could face significant downward pressure, given its current valuation metrics.

Mark Holder, a seasoned investor and leader of the investment group Out Fox The Street, suggests that the market may be mispricing Broadcom’s potential. His insights emphasize the importance of careful evaluation when considering investments in companies like Broadcom, which may not fully capitalize on the rapid growth seen by industry leaders like Nvidia.

Investors seeking to navigate the complexities of the stock market are encouraged to conduct thorough research. Holder’s group provides resources such as model portfolios and daily updates aimed at identifying undervalued stocks.

Investment Considerations

The market’s enthusiasm for AI technologies has led to inflated valuations across the sector. While Broadcom’s recent performance shows promise, the 22% growth reported in FQ3’25 does not reflect the same acceleration seen in its competitors. This prompts a reevaluation of investment strategies, as the potential for a correction looms if market conditions shift.

Investors are advised to remain cautious, as the high premiums currently placed on stocks like Broadcom may not be justified by their actual growth metrics. As the technology landscape evolves, companies that fail to keep pace with industry leaders may find themselves facing significant challenges.

In light of these developments, it is crucial for investors to remain informed and consider the implications of market dynamics on their investment choices.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Top Stories1 week ago

Top Stories1 week agoFamily Remembers Beverley Rowbotham 25 Years After Murder

-

Top Stories4 days ago

Top Stories4 days agoBlake Snell’s Frustration Ignites Toronto Blue Jays Fan Fury