Business

Enterprise Products Partners Reports Q3 Earnings with $1.8 Billion Cash Flow

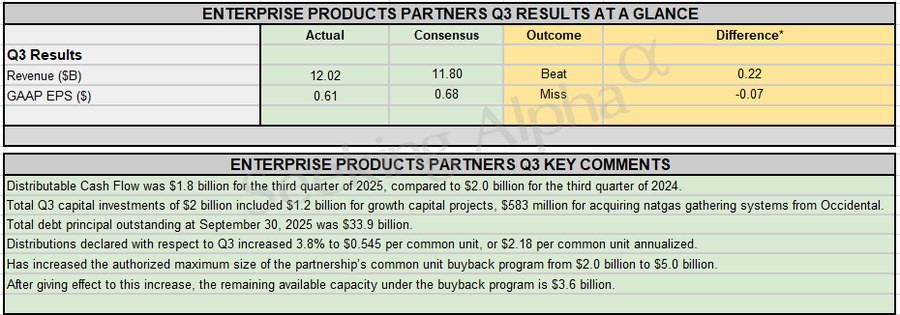

Enterprise Products Partners, a leading midstream energy company based in Houston, Texas, reported its third-quarter earnings for 2023, showcasing a mixed performance amid fluctuating market conditions. The company recorded a distributable cash flow of $1.8 billion, a figure that reflects both resilience and challenges in the current energy landscape.

In the earnings report released on October 30, 2023, Enterprise Products Partners highlighted several key financial metrics. Total revenues reached $12 billion, slightly below analysts’ expectations. The company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) stood at $3.2 billion, marking a decrease compared to the same quarter last year.

Financial Highlights and Operational Insights

Despite the decline in revenues, Enterprise Products Partners maintained a robust distributable cash flow, benefiting from its diverse portfolio and strategic investments in infrastructure. The company’s strong cash flow generation is crucial for supporting its ongoing capital projects and returning value to shareholders through dividends.

During the quarter, the company reported a net income of $1 billion, reflecting a year-over-year decrease driven by lower commodity prices and reduced demand. The average price of natural gas fell significantly, impacting the overall revenue stream. However, the company’s management remains optimistic about future growth, citing the importance of long-term contracts that provide stability amid market volatility.

Enterprise Products Partners also emphasized its commitment to environmental sustainability. In the earnings call, executives discussed ongoing efforts to reduce emissions and enhance operational efficiency. The company is investing in technologies that promote cleaner energy solutions, aligning with broader industry trends towards sustainability.

Future Outlook and Strategic Initiatives

Looking ahead, Enterprise Products Partners plans to focus on expanding its pipeline infrastructure and enhancing its service offerings. The company anticipates increased demand for natural gas and liquefied natural gas (LNG), particularly from international markets.

With several projects in the pipeline, including expansions in the Permian Basin, Enterprise Products Partners aims to capitalize on rising energy needs. The company is also exploring opportunities in renewable energy, positioning itself as a key player in the evolving energy landscape.

As Enterprise Products Partners navigates the challenges of the current market, stakeholders will be keen to monitor how the company adapts its strategy to sustain growth and profitability in the coming quarters. The strong distributable cash flow serves as a solid foundation as it moves forward, ensuring the company remains well-equipped to respond to both opportunities and challenges in the dynamic energy sector.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment4 months ago

Entertainment4 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Top Stories6 days ago

Top Stories6 days agoFamily Remembers Beverley Rowbotham 25 Years After Murder