Business

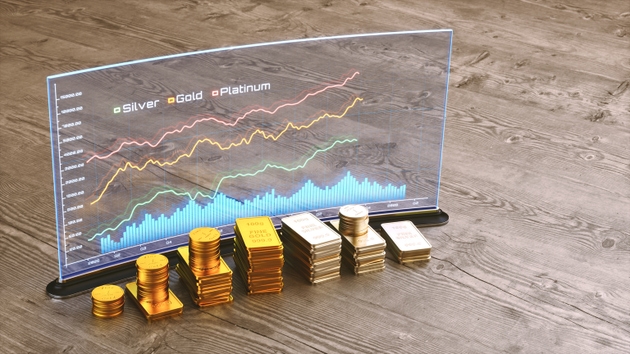

Gold and Silver Prices Rebound as Market Stabilizes and Dollar Weakens

Following a significant decline from record highs, both gold and silver have experienced a resurgence in buying interest. This shift has occurred as broader market conditions show signs of stabilization, coupled with a weakening of the US dollar. The historical inverse relationship between precious metals and the US dollar has once again come into play, making gold and silver particularly responsive to fluctuations in foreign exchange rates.

The recent downturn in gold and silver prices marked one of the sharpest corrections seen in over a decade. Prices for gold dropped substantially, reflecting heightened volatility across financial markets. However, as conditions improve, investors are returning to these precious metals, viewing them as a safe-haven asset amid ongoing economic uncertainties.

The correction in precious metals does not appear to signal a fundamental shift in the broader macroeconomic narrative. Instead, analysts suggest that gold and silver are likely to increase in value at a steadier pace rather than replicate the explosive rallies witnessed in the previous months. According to Ewa Manthey, a Commodities Strategist, this indicates a potential for gradual gains rather than sharp spikes.

Market Dynamics and Future Outlook

As of March 2024, gold prices are showing signs of recovery, supported by a decline in the US dollar’s strength. This development suggests that investors may be re-evaluating their portfolios in light of changing economic conditions. The ongoing geopolitical tensions and inflationary pressures continue to drive some investors towards gold and silver as protective assets.

The recent correction has left gold trading near $1,900 per ounce, while silver has rebounded to approximately $24 per ounce. These prices reflect a renewed confidence among investors who believe that precious metals will maintain their value in times of economic uncertainty.

Moreover, the relationship between precious metals and the US dollar has been a critical factor in recent trading sessions. A weaker dollar generally enhances the appeal of gold and silver, as they become less expensive for holders of other currencies. The market’s responsiveness to currency fluctuations indicates that investors remain attuned to macroeconomic signals.

With the current market conditions, it appears that the trajectory for gold and silver will be characterized by stability rather than volatility. Investors are advised to monitor currency movements closely, as these will likely continue to influence prices in the near term.

In conclusion, while the recent correction in precious metals has raised concerns, the overall outlook remains positive. As the market stabilizes and the US dollar continues to soften, gold and silver are poised for a gradual climb, reflecting their enduring status as essential components of investment portfolios.

-

Politics3 months ago

Politics3 months agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World7 months ago

World7 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Top Stories1 month ago

Top Stories1 month agoUrgent Fire Erupts at Salvation Army on Christmas Evening

-

Sports1 month ago

Sports1 month agoCanadian Curler E.J. Harnden Announces Retirement from Competition

-

Lifestyle5 months ago

Lifestyle5 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoFatal Crash on Highway 11 Claims Three Lives, Major Closure Ongoing

-

Entertainment7 months ago

Entertainment7 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science7 months ago

Science7 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle7 months ago

Lifestyle7 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology5 months ago

Technology5 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoBlue Jays Sign Kazuma Okamoto: Impact on Bo Bichette’s Future

-

Top Stories2 months ago

Top Stories2 months agoNHL Teams Inquire About Marc-André Fleury’s Potential Return