Business

Goldman Sachs GQG Partners Fund Underperforms in Q2 2025

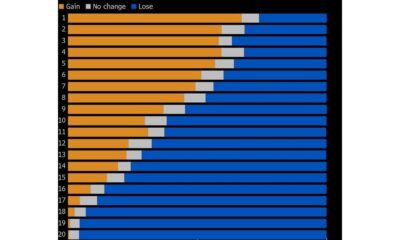

The Goldman Sachs GQG Partners International Opportunities Fund experienced a significant underperformance during the second quarter of 2025, lagging behind the MSCI ACWI ex-USA (Net) benchmark by 499 basis points after fees. This decline can be attributed mainly to the Fund’s allocation and stock selection within the Energy sector, which negatively impacted relative performance. Additionally, stock selection in Europe, excluding the UK, was the largest detractor from the Fund’s overall results.

Market Overview and Sector Performance

During the same period, the MSCI ACWI index achieved a notable gain of 11.53%, benefiting from positive returns across nine of its eleven sectors. The most significant contributors to this benchmark’s performance were found in the Information Technology sector, which surged by 23.4%, adding 560 basis points to the overall performance.

The contrasting results between the Fund and the benchmark highlight the challenges faced by the GQG Partners Fund in capitalizing on the broader market rally. While the benchmark thrived on the strength of technology stocks, the Fund’s positioning in Energy and its selections in European equities proved to be detrimental.

Stock selection strategies are crucial in such fluctuating markets, and the second quarter underscored the importance of adapting to sectoral shifts. Investors are increasingly scrutinizing funds based on their ability to navigate these dynamics effectively.

Implications for Investors

The underperformance of the Goldman Sachs GQG Partners Fund raises important questions for current and potential investors regarding the Fund’s strategy and future direction. With the MSCI ACWI demonstrating strong gains, the disparity in performance may prompt stakeholders to reassess their investment choices.

A thorough analysis of sector allocation and geographic exposure can provide insights into the challenges faced during Q2 2025. As the market evolves, the Fund’s management team will need to refine their strategies to enhance performance and regain investor confidence.

Capital markets remain unpredictable, and the ability to pivot quickly in response to market trends will be critical for fund managers navigating the complexities of global investing. Stakeholders will be closely monitoring upcoming reports and adjustments in strategy to gauge the Fund’s potential recovery and alignment with broader market trends.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025