Business

InTEST Faces Execution Challenges Amid Cyclical Recovery Prospects

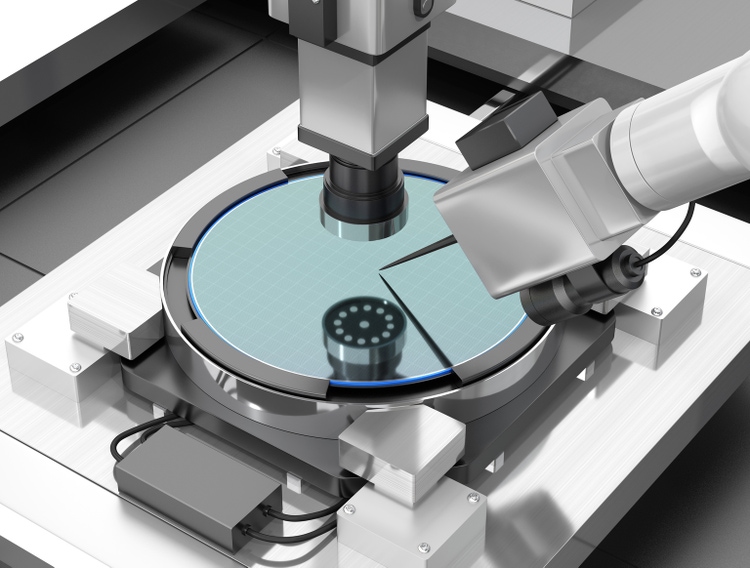

InTEST Corporation, trading under the ticker symbol INTT on the NYSE, designs and manufactures testing and process equipment for various industries, including semiconductors, electric vehicles (EVs), batteries, and life sciences. The company has demonstrated strong gross margins, reflecting a competitive position in the market. However, recent profitability has been adversely impacted by cyclical trends in capital expenditures, particularly within the semiconductor sector.

The company’s performance is closely tied to the health of the semiconductor industry, which has faced significant fluctuations in demand. These cyclical trends have resulted in inconsistent financial results over recent years. Despite maintaining a net cash position and an improved balance sheet, InTEST has struggled with execution challenges and cost control, particularly in areas related to selling, general, and administrative expenses (SG&A).

Investors are currently evaluating InTEST‘s long-term potential in light of these issues. While the company shows promise for cyclical recovery, the past execution hurdles raise concerns about its ability to achieve sustained operational improvement. Analysts are cautious about the stock’s outlook, leading to a recommendation of a Hold rating for INTT as they await clearer indicators of progress.

One of the key factors influencing InTEST‘s future is its operational execution. The company has previously faced challenges in managing costs effectively, and analysts suggest that these issues could limit any upside potential. The semiconductor industry’s capital expenditure trends will remain a critical determinant of InTEST‘s performance in the upcoming quarters.

As of now, the company’s valuation reflects these ongoing risks. Investors are advised to carefully monitor developments related to InTEST’s operational strategies and market conditions. The consensus is that a clearer trajectory of improvement is necessary before any bullish sentiment can be justified regarding the stock.

In summary, while InTEST Corporation has the potential for cyclical recovery, the combination of execution challenges and cost management issues leads to a cautious stance on its long-term prospects. Investors should remain vigilant for signs of operational enhancement before considering an increase in their positions.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025