Business

Market Rotation Accelerates with Small Caps and Commodity Trends

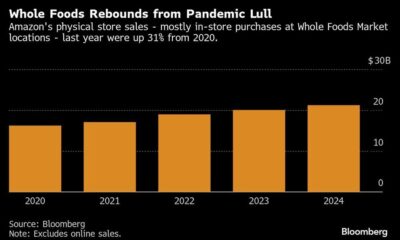

Investors are witnessing a notable market rotation as small-cap stocks and commodities take center stage, prompting discussions about the potential for a “Santa rally” in the coming weeks. This shift comes amidst a pullback in growth stocks, particularly affecting major players like Amazon.com Inc, which has seen significant fluctuations in market performance.

The SmallCap 2000 index has emerged as a focal point for investors, demonstrating resilience as larger growth stocks face challenges. Small-cap stocks are traditionally viewed as more sensitive to economic cycles, and their current momentum suggests a shift in investor sentiment towards sectors that could benefit from a recovering economy. This change is particularly evident as investors seek opportunities beyond the tech giants that have dominated the market for much of the year.

Gold futures have also experienced a surge, reflecting increasing demand for safe-haven assets as economic uncertainty persists. As of December 1, 2023, gold was trading at approximately $1,950 per ounce, up from earlier lows. This rise is indicative of a broader trend among investors who are hedging against inflation and potential market volatility.

In the realm of energy, crude oil WTI futures have demonstrated a similar upward trajectory, with prices climbing to around $85 per barrel. Factors contributing to this increase include ongoing geopolitical tensions and supply chain disruptions that have affected global oil production. Analysts suggest that these conditions could sustain higher prices in the short term, further influencing market dynamics.

The implications of these shifts extend beyond immediate market performance. According to analysis from Investing.com, the rotation towards small caps and commodities could signal a broader realignment in investment strategies as year-end approaches. Investors may be positioning themselves for a potential rally, which historically occurs during the holiday season, often referred to as the “Santa rally.”

As the market continues to evolve, keeping a close eye on these trends will be essential for investors navigating the complexities of the current economic landscape. The performance of Amazon.com Inc and the broader implications for growth stocks could shape investor strategies as 2023 draws to a close.

With the end of the year approaching, market watchers will be keen to see whether the optimism surrounding small-cap stocks will materialize into a year-end rally, and how commodities will play a role in shaping the investment landscape in early 2024. The next few weeks will be critical as investors assess their positions and adapt to the changing market environment.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025