Business

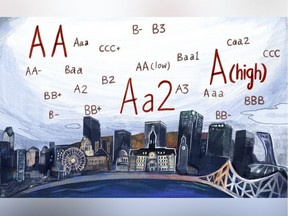

Montreal’s Credit Rating: Insights from Moody’s Analysis

Montreal’s credit rating has come under scrutiny, with discussions highlighting its standing among Canadian municipalities. According to a recent analysis by Michael Yake, an associate managing director at Moody’s, the city occupies a unique position within the ratings spectrum.

Yake noted that Montreal is “at the lower end of what we see for the rated Canadian municipalities, but it’s still a very strong, highly rated entity.” This statement reflects the city’s financial health while acknowledging the competitive landscape of credit ratings among Canadian cities.

Understanding Montreal’s Position

Montreal’s credit rating is essential for its financial operations, influencing borrowing costs and investment attractiveness. The city’s rating, while lower compared to some peers, remains robust. Yake’s comments suggest that despite challenges, Montreal maintains solid fundamentals.

Credit ratings serve as a crucial indicator for investors, impacting the city’s ability to finance infrastructure projects and public services. A strong credit rating typically leads to lower interest rates on bonds, which can save taxpayers money in the long run.

Montreal’s current rating reflects both its economic strengths and the pressures it faces. The city’s diverse economy, cultural significance, and population size contribute positively to its overall creditworthiness. However, like many municipalities, it also contends with fiscal challenges that can affect its rating.

The Broader Context of Canadian Municipal Ratings

In the context of Canadian municipalities, Montreal is part of a broader financial landscape. The ratings of various cities are influenced by factors such as economic performance, debt levels, and governance. Analyzing Montreal’s rating alongside other municipalities provides valuable insights into its relative position.

Yake emphasized that while Montreal’s rating is lower, the city’s financial management and strategic planning play a significant role in maintaining its strong standing. This resilience is vital as municipalities navigate evolving economic conditions.

As of September 2023, the conversation around Montreal’s credit rating serves as a reminder of the complexities involved in municipal finance. Stakeholders, including residents, investors, and policymakers, are keenly interested in these ratings, which can have far-reaching implications for public investment and service delivery.

In conclusion, while Montreal may rank lower than some of its Canadian counterparts, the perspective provided by Moody’s highlights its overall strength. Understanding these nuances is crucial for anyone invested in the city’s financial future and operational capabilities.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories6 days ago

Top Stories6 days agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics2 months ago

Politics2 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics7 days ago

Politics7 days agoShutdown Reflects Democratic Struggles Amid Economic Concerns