Business

Real Estate Stocks Decline 1.50% Amid Uncertain 2025 Outlook

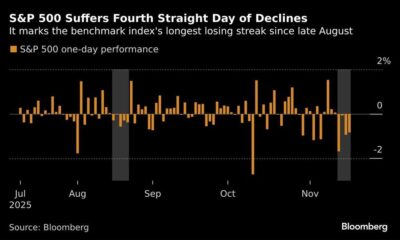

The S&P 500 Real Estate Index Sector experienced a decline of 1.50% this week, reflecting ongoing uncertainty in the real estate market. Investors are grappling with unpredictable trajectories for property returns as the year progresses. This drop contributes to a broader trend of volatility observed in real estate stocks, raising concerns among market analysts.

As of now, the returns across various property types are anticipated to diverge significantly. The fluctuations highlight the challenges faced by investors in navigating the current landscape. This week’s performance underscores the ongoing unpredictability in real estate, making it difficult for stakeholders to forecast outcomes for 2025.

Despite previous forecasts indicating potential variability, the reality of the market remains complex. Factors such as economic shifts, interest rates, and investor sentiment play critical roles in shaping the future of real estate investments. As these elements evolve, they contribute to the overall uncertainty, leaving many to reconsider their positions within the market.

Market analysts suggest that the decline in the S&P 500 Real Estate Index is part of a larger pattern. The sector has struggled to maintain consistent growth, with various economic indicators impacting investor confidence. The recent performance may prompt a reevaluation of strategies among those heavily invested in real estate assets.

Looking ahead, stakeholders are advised to remain vigilant. The unpredictability of returns means that strategies must be adaptable. Investors are encouraged to stay informed about market trends and economic developments that could influence their portfolios.

In summary, with the S&P 500 Real Estate Index down 1.50% this week, the outlook for real estate stocks remains uncertain as the year unfolds. Investors will need to navigate these challenging conditions carefully as they plan for the future.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Top Stories1 week ago

Top Stories1 week agoHomemade Houseboat ‘Neverlanding’ Captivates Lake Huron Voyagers