Business

Reliance Industries Set to Prosper from China’s Price Regulation Efforts

India’s Reliance Industries Ltd. is poised to benefit significantly from China’s efforts to curb price wars across various sectors, according to a recent analysis by Morgan Stanley. The investment firm highlights that the conglomerate, led by billionaire Mukesh Ambani, stands as the largest beneficiary of China’s anti-involution initiatives targeting the energy and solar supply chains.

In a note dated September 1, 2023, analysts including Mayank Maheshwari emphasized that Reliance’s strategic moves to streamline its operations align well with China’s broader economic goals. The term “involution” describes the intense competition in China that yields minimal returns, while “anti-involution” refers to efforts by companies and government entities to mitigate this trend. These shifts are expected to bolster market conditions as Beijing seeks to combat deflation.

Reliance is actively constructing a fully integrated solar supply chain within India. This development is particularly timely, as China’s overcapacity in polysilicon production compels it to rationalize its output. Morgan Stanley estimates that these changes could lead to a reduction in Reliance’s energy costs by as much as 40% by 2030. Furthermore, the company’s new-energy earnings contributions are projected to reach 13% by 2027.

Analysts at Morgan Stanley believe that China’s anti-involution initiatives signal a turning point for the petrochemical cycle, which has faced downward pressure for some time. The measures taken to address overcapacity in the solar industry are expected to enhance pricing for Reliance’s solar supply chain. They project that these anti-involution efforts will add an impressive $20 billion in net asset value and increase earnings estimates by 17% for the fiscal year 2028.

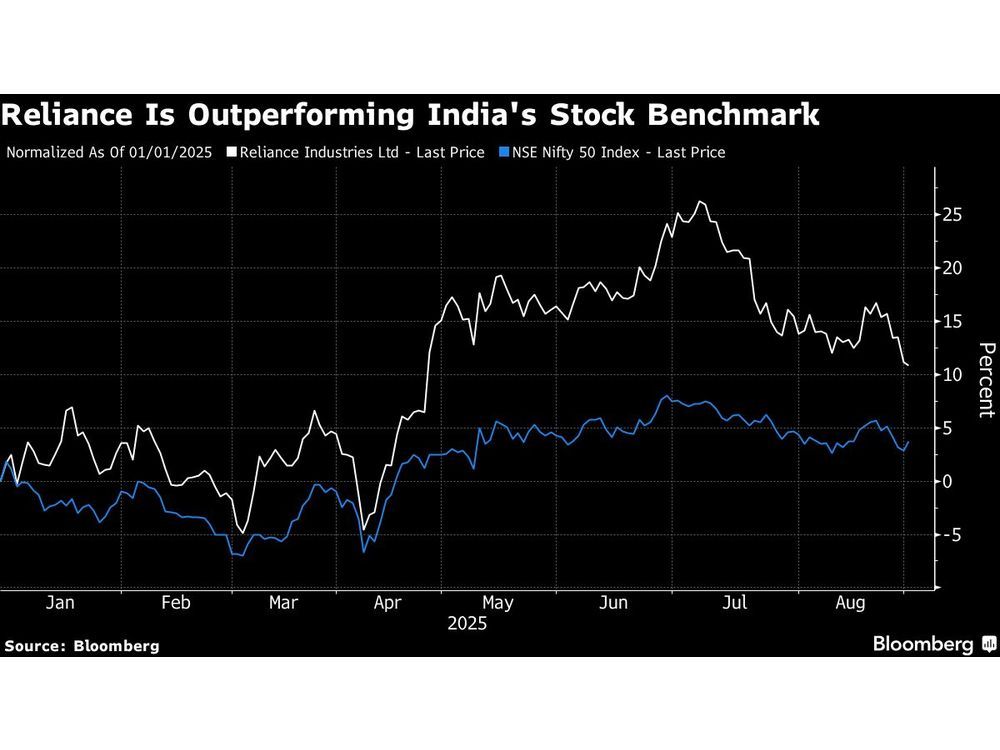

Morgan Stanley has maintained an overweight rating on Reliance’s stock, raising its 12-month price target from 1,602 rupees to 1,701 rupees. This adjustment suggests a potential upside of 26% from the stock’s closing price on the previous Monday. The analysts noted that current valuations of the stock imply negligible value attributed to new energy and artificial intelligence investments, alongside limited growth prospects in the fast-moving consumer goods (FMCG) sector.

As Reliance Industries continues to align its strategies with global market trends, it remains well-positioned to capitalize on the evolving dynamics of both the Indian and Chinese economies. The company’s proactive approach in adapting to these changes may yield substantial benefits in the coming years, marked by enhanced earnings and a stronger market position.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025