Business

Russell 2000 Challenges $252 Resistance as Bitcoin Rebounds

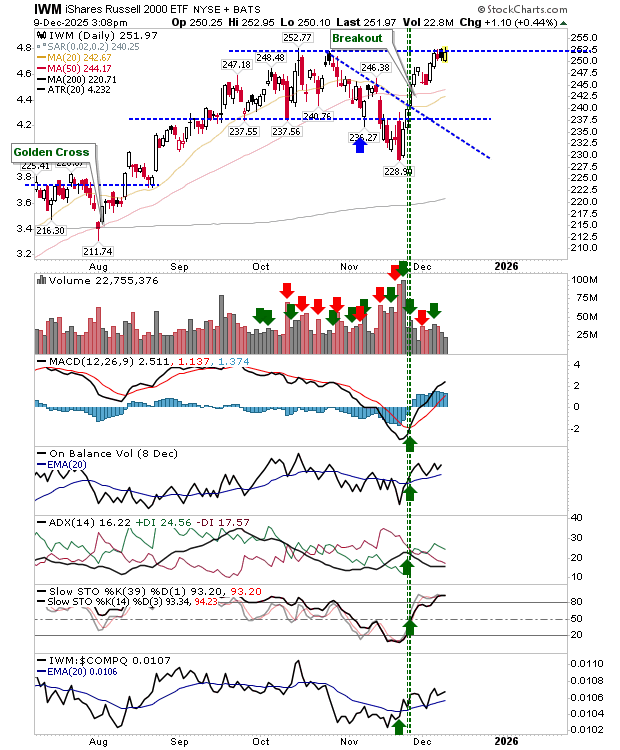

The Russell 2000 Index is once again testing the $252 resistance level, a significant threshold as market dynamics shift. Despite a lack of substantial trading volume, sellers have shown hesitance to capitalize on profits, indicating potential bullish momentum. Should the index successfully breach this level, increased trading activity is anticipated, reflecting heightened investor interest.

Currently, the Russell 2000 has entered an overbought state, with the Moving Average Convergence Divergence (MACD) indicator positioned above the bullish zero line. This technical improvement signals a more favorable outlook compared to mid-October, when the index last faced the $252 mark. Since bouncing off the lows in November, the Russell 2000 has outperformed the Nasdaq, which remains below its previous October highs.

Bitcoin’s Recent Performance and Market Implications

Bitcoin ($BTCUSD) has also seen fluctuations but is now approaching its last swing high after experiencing a bullish reversal spike at $80,000 in November. Although it faced some challenges in its recent bounce, the cryptocurrency is now poised for potential gains. For traders, there may be opportunities for short-term strategies targeting the 50-day moving average, while long-term investors might consider Bitcoin a viable option, despite some lingering skepticism regarding cryptocurrencies.

The S&P 500 shares a similar trajectory with the Nasdaq, both indices struggling to gain momentum. While technical indicators lean positively overall, the S&P 500 is currently considered the “weakest” compared to its peers. There exists a notable buying opportunity within the Russell 2000, particularly given the relative stability of the Nasdaq and S&P 500.

The potential for a breakout in the Russell 2000 could propel the index into a 5% range of historic price extremes, relative to its 200-day moving average. This transition could open further trading opportunities, particularly if Bitcoin can manage to challenge its 50-day moving average, thereby impacting the Nasdaq’s trajectory towards new all-time highs.

Investors are encouraged to keep a close watch on these indices, as market conditions evolve and new trading opportunities arise. The interplay between the Russell 2000 and Bitcoin will likely shape investor sentiment and market strategies in the coming days.

-

Politics3 months ago

Politics3 months agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World7 months ago

World7 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Top Stories1 month ago

Top Stories1 month agoUrgent Fire Erupts at Salvation Army on Christmas Evening

-

Sports1 month ago

Sports1 month agoCanadian Curler E.J. Harnden Announces Retirement from Competition

-

Lifestyle5 months ago

Lifestyle5 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoFatal Crash on Highway 11 Claims Three Lives, Major Closure Ongoing

-

Entertainment7 months ago

Entertainment7 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science7 months ago

Science7 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle7 months ago

Lifestyle7 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology5 months ago

Technology5 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoBlue Jays Sign Kazuma Okamoto: Impact on Bo Bichette’s Future

-

Top Stories2 months ago

Top Stories2 months agoNHL Teams Inquire About Marc-André Fleury’s Potential Return