Business

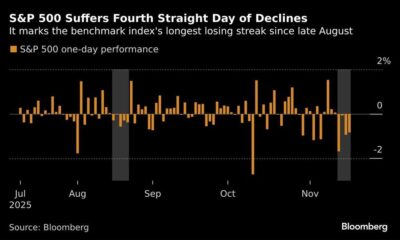

S&P 500 Faces Correction as Long-Term Trend Shows Vulnerability

The S&P 500 index experienced a notable decline of 1.94% last week, prompting analysts to reassess its ongoing bullish long-term trend. This drop followed a period of heightened optimism, raising concerns about the sustainability of the current market momentum. Analysts suggest that while a short-term rally is anticipated, the potential for further gains may be limited due to structural vulnerabilities in the market.

The recent dip held key support levels, particularly at 6551, which was previously identified as a critical threshold. Should the index continue on its current trajectory, it is expected that October will need to close above 6900 to maintain its upward channel. However, many analysts believe that a breakdown is more likely, which could lead to a correction towards the 6343 support area. This scenario may present a buying opportunity for investors looking to capitalize on the next phase of the rally.

Market Analysis and Future Projections

The recent performance of the S&P 500 has been a focal point for investors and analysts. The index, which tracks the performance of 500 large companies listed on stock exchanges in the United States, is often viewed as a barometer of the overall health of the U.S. economy. The recent decline has prompted a reevaluation of market conditions and investor sentiment.

According to market analysts, the current steep daily channel appears vulnerable for several reasons. The index’s ability to maintain its bullish trend depends significantly on external economic factors and investor behavior. If the index breaks below the identified support levels, it could signal a more extensive correction, which might alter the prevailing trend.

Investors are advised to remain cautious, as the volatility seen in recent weeks could lead to unpredictable market movements. The potential for a correction highlights the importance of monitoring key support and resistance levels closely.

Investment Strategies Moving Forward

For those considering investment in the S&P 500, understanding the technical indicators and market sentiment is crucial. The anticipated correction towards 6343 could offer a strategic entry point for investors. Adopting a long-term perspective while navigating short-term fluctuations may prove beneficial in capitalizing on future growth opportunities.

It is essential to recognize that past performance does not guarantee future results, and investment strategies should be tailored to individual risk tolerance and financial objectives. The insights provided are intended for informational purposes and do not constitute financial advice.

As the market continues to evolve, keeping abreast of emerging trends and economic indicators will be vital for making informed investment decisions. Engaging with credible financial sources and analysis can provide valuable context for navigating the complexities of the current market landscape.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025