Business

S&P 500 Faces Volatile Range Ahead of Expected Resolution

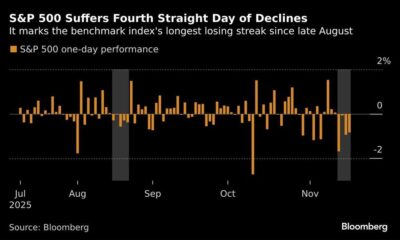

The S&P 500 experienced significant volatility last week, remaining confined within a fluctuating range. Both bullish and bearish investors faced challenges as neither side managed to secure a decisive advantage. A resolution to this uncertainty is anticipated in the coming week, with analysts suggesting a potential downward break, though this may not disrupt the longer-term upward trend.

Recent trading patterns in the S&P 500 have shown sharp swings, indicating a tug-of-war between optimism and pessimism. As of now, the index has not settled into a clear direction, reflecting a broader market indecision. Investors are keenly watching for signs that could indicate a shift, particularly as the volatility has implications for trading strategies.

Market Outlook and Investor Sentiment

Analysts are closely monitoring the situation, with some suggesting that a downward break may be on the horizon. Despite this, many believe that any correction could present a buying opportunity for long-term investors. The overall sentiment remains cautiously optimistic, as the fundamentals supporting the longer-term uptrend in the S&P 500 are still intact.

Market participants are evaluating various factors that could influence the index’s trajectory. Economic data releases, interest rate movements, and corporate earnings reports are all under scrutiny. These elements will play a critical role in shaping investor sentiment and could catalyze a resolution to the current volatility.

The S&P 500, a benchmark for U.S. equities, is closely watched by investors globally. Its movements can offer insights into the overall health of the economy and investor confidence. As such, the upcoming week is poised to be pivotal in determining the index’s direction.

Technical Analysis and Trading Strategies

Technical analysts are examining key price levels that may signal future movements. The trading range established in recent weeks has created uncertainty, but it may also be setting the stage for a significant breakout. Traders are advised to be vigilant and prepared for rapid changes in market sentiment, as both bullish and bearish positions could be tested.

In conclusion, the S&P 500 is currently navigating a volatile environment, with a potential resolution expected soon. While some analysts advocate for caution, others view this period as an opportunity to capitalize on potential market corrections. As the week unfolds, investors will remain attentive to developments that could clarify the index’s future path.

-

Politics4 weeks ago

Politics4 weeks agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology3 months ago

Technology3 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Technology5 months ago

Technology5 months agoFrosthaven Launches Early Access on July 31, 2025