Business

Trump and Albanese Forge $8.5 Billion Rare Earth Supply Chain Deal

The United States has taken significant steps to reduce its reliance on China for rare earth minerals, announcing an ambitious plan involving an investment of $8.5 billion. In a meeting at the White House in October 2023, President Donald Trump and Australian Prime Minister Anthony Albanese signed an agreement aimed at bolstering the critical minerals supply chain. This deal marks a crucial effort to secure a more stable and independent supply of rare earths, which are essential for various high-tech applications, including electric vehicles, semiconductors, and military technologies.

Rare earths are vital for modern technology, and currently, China dominates the global market, controlling approximately 70 percent of the world’s rare earth reserves, estimated at 44 million metric tonnes. In contrast, Brazil, India, and Australia hold significantly smaller reserves, with Brazil at 21 million tonnes, India at 6.9 million tonnes, and Australia at 5.7 million tonnes. The partnership with Australia is strategically significant for the United States, as it seeks to counteract China’s influence in this critical sector.

Following the signing of the agreement, Albanese announced the formation of three joint project groups, which will involve companies such as the U.S. aluminum firm Alcoa. The package includes an initial investment of $3 billion from the United States for mining and processing initiatives and establishes a price floor for critical minerals. The White House also revealed plans to build a gallium refinery in Western Australia, with a projected capacity of 100 metric tonnes annually. This investment is expected to unlock deposits of critical minerals valued at $53 billion.

Trump expressed confidence in the initiative, stating, “In about a year from now, we’ll have so much critical mineral and rare earths that you won’t know what to do with them.” He also indicated that the United States is exploring partnerships with other countries to diversify its critical mineral supply chains, beyond just Australia. However, experts in the sector caution that developing Australia’s rare earth market could take between five to seven years.

As the U.S. and Australia advance their plans, China continues to maintain a substantial grip on the rare earths market, accounting for around 90 percent of the world’s rare earth refining capacity and 98 percent of magnet manufacturing. In response to the U.S.-Australia agreement, China’s Ministry of Foreign Affairs stressed the importance of resource-rich nations ensuring stability in industrial and supply chains. The ministry’s spokesperson, Guo Jiakun, underscored the need for cooperation in economic and trade matters.

In a related development, China’s Commerce Ministry recently announced further restrictions on the export of rare earths. This move aims to prevent the “misuse” of these minerals in military applications and includes new compliance rules for foreign producers utilizing Chinese materials. Such actions have raised alarms within the industry regarding the lack of diversity in global supply chains and the potential negative impacts of China’s export policies.

The rare earth market was valued at approximately $6 billion in 2024, according to Goldman Sachs. The financial institution warned that a 10 percent disruption in industries dependent on rare earths could result in economic losses of about $150 billion. Specific elements like samarium, graphite, lutetium, and terbium are particularly vulnerable to reductions in exports. While Western companies like Lynas Rare Earths and Solvay could help mitigate shortages, reliance on China remains a significant concern.

Goldman Sachs also highlighted the timeline for developing new rare earth mines, estimating it could take between eight to ten years. This underscores the challenges many countries face in building the necessary expertise and infrastructure to support mining initiatives. In addition to collaborating with Australia, the U.S. government is considering establishing a strategic reserve of rare earths and is looking to support domestic producers through price controls and tariffs.

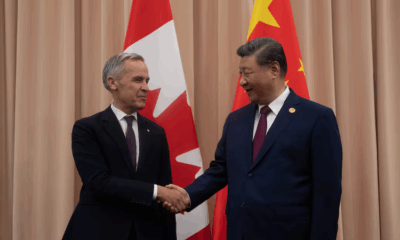

During a recent trip to Asia, Trump signed agreements with several countries, including Japan, Malaysia, Thailand, Vietnam, and Cambodia, to enhance access to critical minerals. Additionally, the U.S. and China have reached a framework agreement to halt the implementation of a 157 percent tariff on Chinese goods, which could pave the way for a potential trade deal between Trump and Chinese leader Xi Jinping.

Despite the ongoing negotiations with China, the Trump administration remains committed to diversifying its critical minerals supply chain and reducing dependence on Chinese resources. As trade relations continue to evolve, the U.S. is expected to invest significantly in energy independence, reinforcing its partnerships with allies to secure a stable supply of essential minerals.

-

World4 months ago

World4 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment4 months ago

Entertainment4 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle4 months ago

Lifestyle4 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science4 months ago

Science4 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories3 weeks ago

Top Stories3 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports4 months ago

Sports4 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology4 months ago

Technology4 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics4 months ago

Politics4 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment4 months ago

Entertainment4 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Top Stories1 week ago

Top Stories1 week agoFamily Remembers Beverley Rowbotham 25 Years After Murder