Business

U.S. Dividend Stocks Poised for Growth as Rate Cuts Loom

Investors are turning their attention back to dividend stocks as expectations grow for a Federal Reserve rate cut. With a reduction in interest rates anticipated at the upcoming meeting on October 25, 2023, there is a significant shift in market dynamics. The Investing.com’s Fed Rate Monitor Tool indicates a greater than 98% probability of this cut, with another expected in December, similarly likely. As cash and bond yields decline, demand for high-dividend equities is surging, potentially setting the stage for a robust end to the year for these stocks.

The current market volatility, driven in part by the ongoing China-U.S. trade tensions, is prompting investors to seek reliable income sources. Dividend stocks traditionally gain traction during such periods, particularly as lower interest rates make these investments more appealing compared to traditional fixed-income assets. These stocks generally exhibit stronger financial stability and attract a more committed shareholder base, ensuring resilience in uncertain times.

Top Dividend Stocks for Consideration

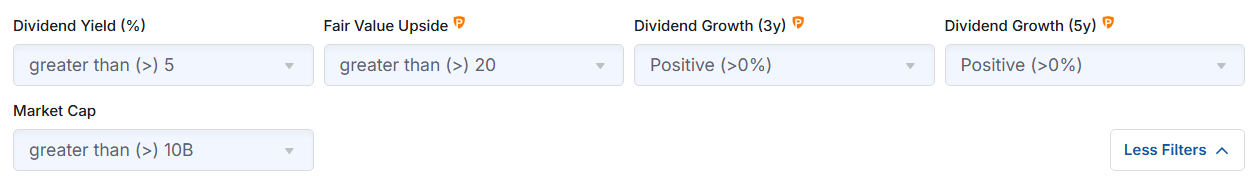

In light of these developments, InvestingPro conducted a thorough analysis to identify ten U.S. stocks that not only feature attractive dividend yields but also demonstrate significant upside potential. The selection criteria included dividend yields of at least 5%, alongside dividend growth rates over three and five years that indicate a commitment to increasing payouts. Additionally, these stocks show a Fair Value upside of at least 20%, suggesting they are currently undervalued.

The resulting list includes stocks that offer annual yields ranging from 5% to 11.9%, with undervaluations between 21.6% and 36.7%. None of these companies have yet released their Q3 earnings, which are expected within the next three weeks. This upcoming earnings season could serve as a catalyst for potential rallies, especially if companies outperform analysts’ expectations, as history has shown.

While the Investing.com screener provides valuable insights, certain advanced features are accessible exclusively to InvestingPro and Pro+ subscribers. This highlights the importance of having the right tools and information when navigating the stock market.

In addition to screening capabilities, InvestingPro offers a variety of resources designed to aid investors in making informed decisions. These include AI-managed stock strategies, extensive historical financial data, and a database of positions held by prominent investors and hedge funds. Such resources assist thousands of investors in achieving superior market performance daily.

For those considering diving into dividend stocks as interest rates fall, understanding both the risks and rewards is essential. This article serves as a starting point for those seeking passive income through well-researched investments, but it is crucial to approach all investment decisions with caution.

As always, this information is intended for educational purposes and should not be construed as an investment recommendation. Investors are encouraged to conduct their own thorough analysis before making any financial commitments.

-

World3 months ago

World3 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment3 months ago

Entertainment3 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle3 months ago

Lifestyle3 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science3 months ago

Science3 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Technology2 months ago

Technology2 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 weeks ago

Top Stories2 weeks agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Sports3 months ago

Sports3 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics3 months ago

Politics3 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Technology3 months ago

Technology3 months agoFrosthaven Launches Early Access on July 31, 2025

-

Politics3 months ago

Politics3 months agoCarney Engages First Nations Leaders at Development Law Summit

-

Entertainment3 months ago

Entertainment3 months agoCalgary Theatre Troupe Revives Magic at Winnipeg Fringe Festival

-

Politics2 weeks ago

Politics2 weeks agoShutdown Reflects Democratic Struggles Amid Economic Concerns