Education

Family Expert Shares Simple Strategies for Education Savings

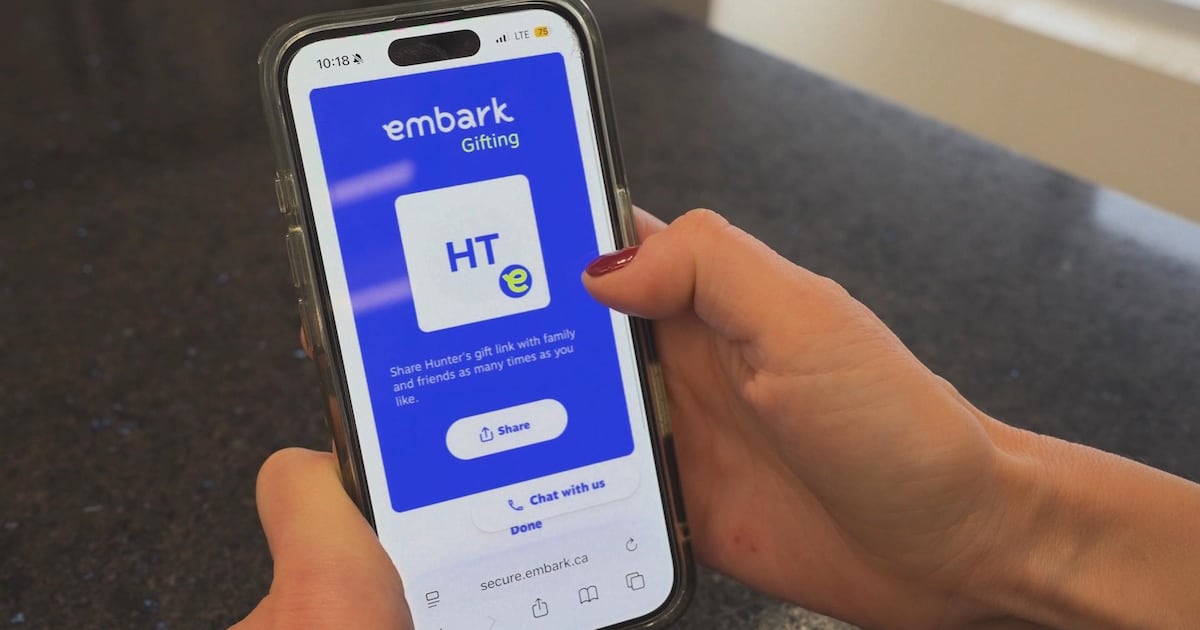

In a recent initiative, a family lifestyle expert has introduced an accessible method for parents to save for their children’s education through a platform called Embark. This service aims to simplify the financial planning process for families, making it easier to prepare for the rising costs of schooling.

Embark provides tools and resources designed to help parents understand their options and make informed decisions about saving for future educational expenses. The expert emphasized the importance of starting early, as educational costs can significantly impact family finances. With tuition fees continuing to rise, many parents are feeling the pressure to secure sufficient funds for their children’s schooling.

The platform offers various savings plans that can be tailored to individual family needs. By utilizing features such as automated contributions and investment tracking, parents can manage their savings effectively. This proactive approach not only alleviates financial stress but also encourages a culture of saving within families.

Understanding the Importance of Educational Savings

The rising cost of education is a pressing concern for many families. According to recent statistics, the average cost of tuition in Canada has increased by approximately 3.2% annually. This trend has prompted parents to seek innovative solutions for financing their children’s academic futures.

Through Embark, families can set specific savings goals and receive personalized recommendations based on their financial situation. This tailored guidance is crucial in helping parents navigate the complexities of education funding. The service also emphasizes the significance of financial literacy, equipping parents with the knowledge they need to make sound financial decisions.

Accessible Resources for All Families

The family lifestyle expert noted that Embark is designed to be user-friendly and accessible to all families, irrespective of their financial background. By offering a variety of resources, including educational articles and calculators, the platform empowers parents to take control of their financial planning.

Moreover, the expert highlighted that utilizing tools like Embark can help foster conversations about money within families, which is essential for developing a healthy attitude toward finances. Encouraging children to participate in discussions about saving and budgeting prepares them for their future financial responsibilities.

In conclusion, the introduction of Embark represents a significant step toward making educational savings more attainable for families. By providing practical tools and knowledge, this platform aims to alleviate some of the financial burdens associated with education, ultimately ensuring that children can pursue their academic aspirations without the weight of overwhelming debt. For more information on how to get started, visit www.embark.ca.

-

Politics1 month ago

Politics1 month agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World5 months ago

World5 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Entertainment5 months ago

Entertainment5 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Lifestyle5 months ago

Lifestyle5 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Science5 months ago

Science5 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle3 months ago

Lifestyle3 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Technology4 months ago

Technology4 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories2 months ago

Top Stories2 months agoUrgent Update: Fatal Crash on Highway 99 Claims Life of Pitt Meadows Man

-

Top Stories2 weeks ago

Top Stories2 weeks agoHomemade Houseboat ‘Neverlanding’ Captivates Lake Huron Voyagers

-

Politics4 months ago

Politics4 months agoUkrainian Tennis Star Elina Svitolina Faces Death Threats Online

-

Sports5 months ago

Sports5 months agoSearch Underway for Missing Hunter Amid Hokkaido Bear Emergency

-

Politics5 months ago

Politics5 months agoCarney Engages First Nations Leaders at Development Law Summit