NEW YORK – Financial markets are poised for a turbulent start as investors digest the repercussions of the U.S. striking three Iranian nuclear facilities over the weekend. The geopolitical tension adds a layer of uncertainty as key economic indicators and corporate earnings reports loom.

Immediate Impact

President Donald Trump announced that Iran’s nuclear enrichment sites had been “obliterated” by U.S. strikes. While the full extent of the damage remains unclear, potential Iranian retaliation could prompt investors to shy away from high-risk assets such as stocks and cryptocurrencies. Meanwhile, oil prices are anticipated to climb due to fears of disrupted supply chains if critical infrastructure is affected.

Key Details Emerge

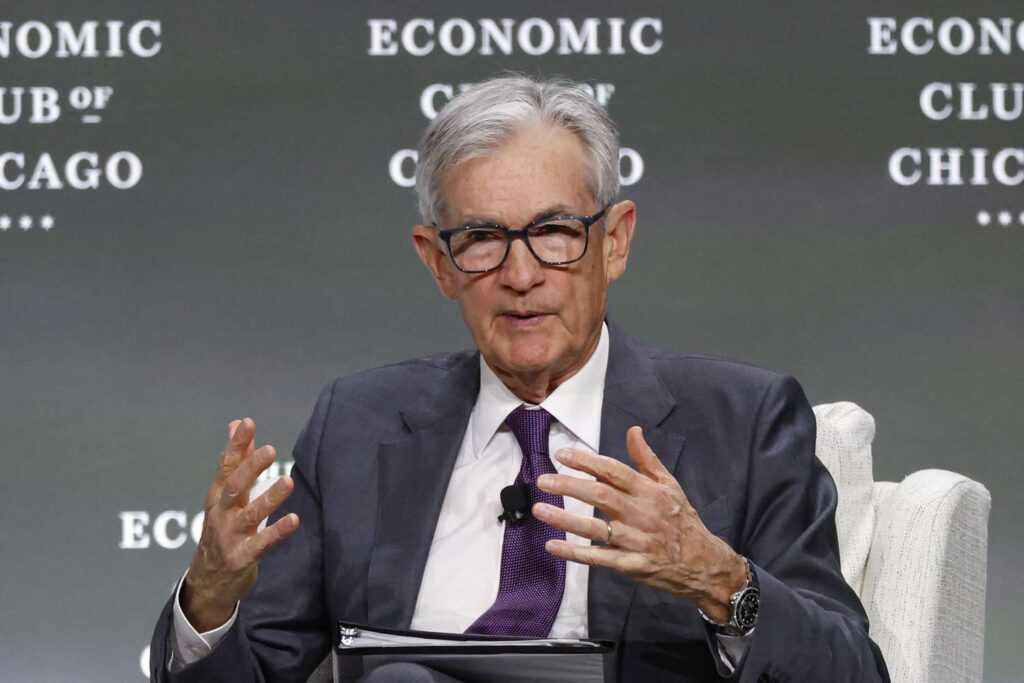

Amid these geopolitical tensions, Federal Reserve Chair Jerome Powell is set to testify before Congress this week, providing insights into the central bank’s economic outlook. The testimony follows a decision to maintain current interest rates, with concerns lingering about inflation potentially reigniting due to ongoing tariffs.

Key Statistic: The Personal Consumption Expenditures (PCE) report for May is due, a crucial metric for gauging inflation trends.

Corporate Earnings in Focus

This week, investors will scrutinize earnings from major corporations, including Nike, FedEx, and Micron Technology. These reports will offer a glimpse into how tariffs are impacting various sectors, from retail to technology.

Industry Response

Nike, a Dow 30 member, will report on Thursday amid previous warnings that tariffs could impede performance. Analysts suggest that recent industry mergers may bolster Nike’s sales despite tariff challenges.

FedEx’s earnings, scheduled for Tuesday, are pivotal as they reflect shipping volumes, a key economic barometer. The company’s prior warnings of reduced revenue and profits will be under scrutiny.

Micron Technology’s report on Wednesday follows its substantial $200 billion investment pledge to enhance U.S. semiconductor production, a strategic move amid global supply chain challenges.

By the Numbers

Upcoming Data:

- Existing home sales (May)

- Consumer confidence (June)

- Gross domestic product (GDP) – second revision (Q1)

- Personal Consumption Expenditures (May)

What Comes Next

As the week progresses, market participants will closely monitor Powell’s congressional testimony, particularly as it may feature pointed questions from political allies of President Trump, who has criticized the Fed’s interest rate stance. The PCE report on Friday will be pivotal, offering further clarity on inflation trends.

Background Context

This development builds on the backdrop of last week’s Federal Reserve meeting, where rates were held steady amid tariff-related inflation concerns. The timing is particularly significant as markets seek direction in a volatile geopolitical landscape.

Expert Analysis

According to sources familiar with the situation, the Fed’s cautious approach reflects a broader strategy to balance economic growth with inflation control. Analysts warn that geopolitical tensions could exacerbate market volatility, urging investors to remain vigilant.

Regional Implications

The move represents a significant shift from previous diplomatic efforts, potentially altering regional power dynamics. Experts suggest that continued instability could further strain global supply chains, particularly in the energy sector.

Timeline of Events

Key Events This Week:

- Monday: Existing home sales, Fed speakers

- Tuesday: Powell’s House testimony, FedEx earnings

- Wednesday: New home sales, Powell’s Senate testimony, Micron earnings

- Thursday: Nike earnings, GDP data

- Friday: PCE report, consumer sentiment

The announcement comes as markets brace for potential disruptions, with investors keeping a keen eye on unfolding events. As geopolitical and economic narratives intertwine, the coming days promise to be pivotal for market direction and investor sentiment.