Sports

Thermo Fisher Scientific Reports Major Drop in Health Fund Holdings

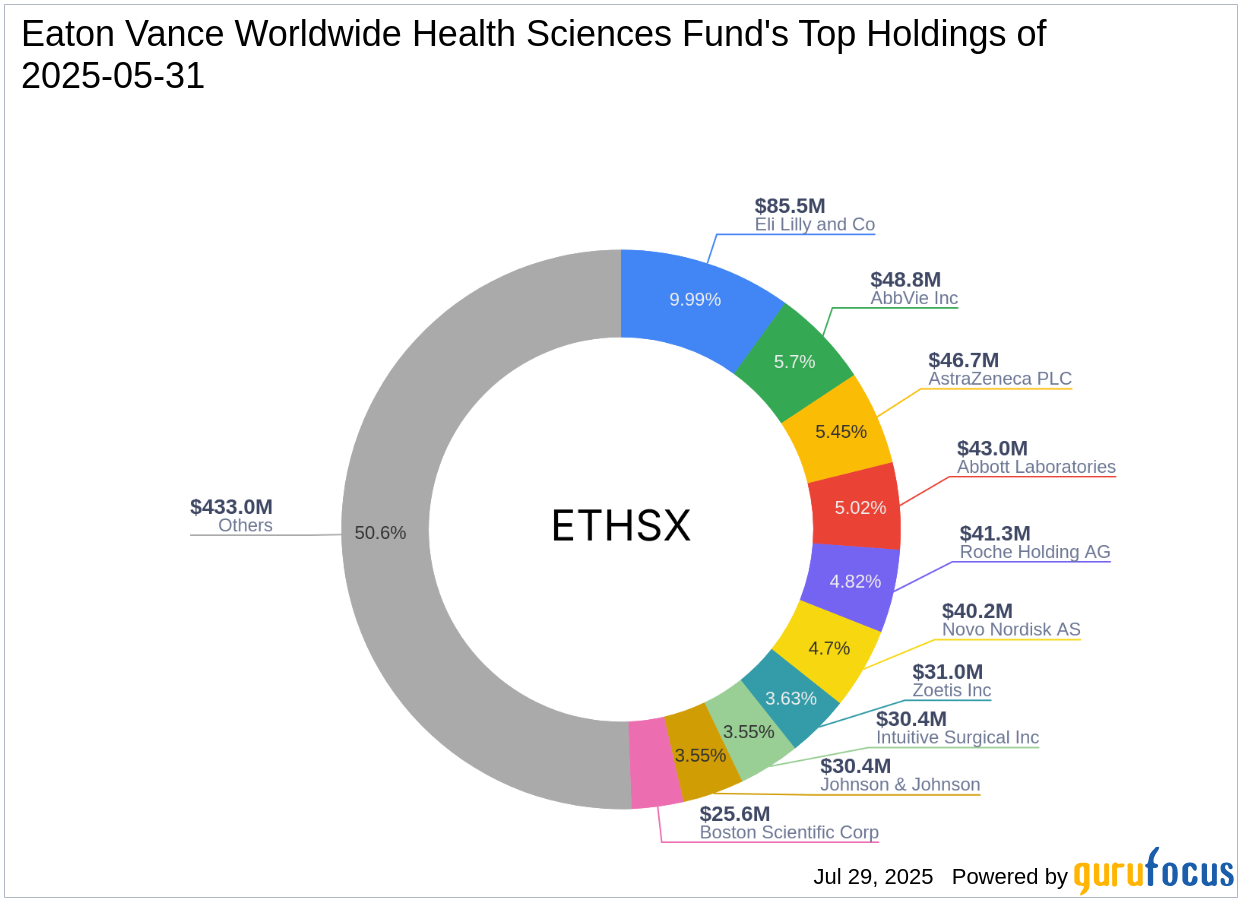

Thermo Fisher Scientific Inc. has reported a significant decrease in its holdings in the Eaton Vance Worldwide Health Fund, according to the company’s Second Quarter 2025 N-PORT filing. This adjustment reflects a shift in investment strategy that has seen the total value of its holdings drop from $1.2 billion to approximately $600 million over the past quarter.

The filing, which provides insights into institutional investment activities, highlights a strategic reevaluation by Thermo Fisher. The company, headquartered in Boston, Massachusetts, has opted to reduce its exposure to this health-focused fund, which typically invests in companies involved in pharmaceuticals, biotechnology, and medical devices.

Investment Strategy Changes and Market Implications

This decision comes as part of a broader trend in the market where companies reassess their portfolios in response to changing economic conditions. The healthcare sector has faced various challenges, including regulatory shifts and the ongoing impact of global supply chain disruptions. By scaling back its investment in the Eaton Vance fund, Thermo Fisher aims to realign its resources towards areas that promise better growth potential.

Analysts note that Thermo Fisher’s reduction in holdings could also be influenced by the performance of the health sector. The Eaton Vance Worldwide Health Fund has experienced fluctuations in returns, prompting investors to reconsider their positions. As a result, major players like Thermo Fisher and others, including BlackRock, Inc. and Vanguard Group, are adjusting their strategies to mitigate risk.

Future Outlook for Thermo Fisher

Looking ahead, Thermo Fisher Scientific is expected to focus on diversifying its investment portfolio. This includes exploring opportunities in emerging markets and innovative technologies that align more closely with its core business operations. The company’s leadership has emphasized its commitment to maintaining a robust financial position while navigating the complexities of the current market landscape.

In conclusion, Thermo Fisher Scientific’s recent moves reflect a proactive approach to investment management, one that prioritizes resilience and adaptability. The significant reduction in its holdings in the Eaton Vance Worldwide Health Fund signals a pivotal moment for the company as it seeks to optimize its financial strategy amid evolving market dynamics.

-

Politics3 months ago

Politics3 months agoSecwepemc First Nation Seeks Aboriginal Title Over Kamloops Area

-

World7 months ago

World7 months agoScientists Unearth Ancient Antarctic Ice to Unlock Climate Secrets

-

Top Stories1 month ago

Top Stories1 month agoUrgent Fire Erupts at Salvation Army on Christmas Evening

-

Sports1 month ago

Sports1 month agoCanadian Curler E.J. Harnden Announces Retirement from Competition

-

Lifestyle5 months ago

Lifestyle5 months agoManitoba’s Burger Champion Shines Again Amid Dining Innovations

-

Top Stories2 months ago

Top Stories2 months agoFatal Crash on Highway 11 Claims Three Lives, Major Closure Ongoing

-

Entertainment7 months ago

Entertainment7 months agoTrump and McCormick to Announce $70 Billion Energy Investments

-

Science7 months ago

Science7 months agoFour Astronauts Return to Earth After International Space Station Mission

-

Lifestyle7 months ago

Lifestyle7 months agoTransLink Launches Food Truck Program to Boost Revenue in Vancouver

-

Technology5 months ago

Technology5 months agoApple Notes Enhances Functionality with Markdown Support in macOS 26

-

Top Stories1 month ago

Top Stories1 month agoBlue Jays Sign Kazuma Okamoto: Impact on Bo Bichette’s Future

-

Top Stories2 months ago

Top Stories2 months agoNHL Teams Inquire About Marc-André Fleury’s Potential Return